全球价值链以及国家和行业效应在国际投资组合多样化中不断变化的作用

IF 1.7

4区 工程技术

Q2 MATHEMATICS, INTERDISCIPLINARY APPLICATIONS

引用次数: 0

摘要

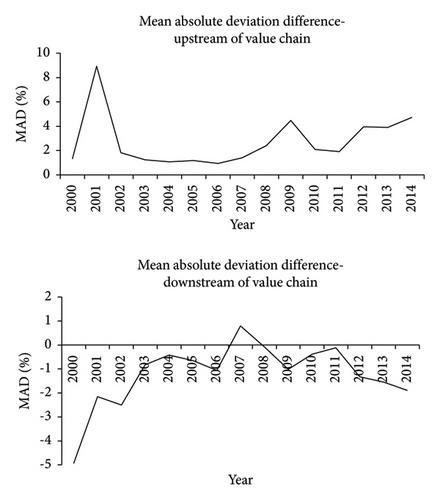

我们发现,在全球价值链的上游,国家效应相对强于产业效应;在全球价值链的下游,产业效应主导国家效应。金融危机期间,在价值链下游,产业效应的影响减弱,国家效应上升。此外,对发达国家而言,价值链上游地位的负面影响明显减弱;对新兴市场而言,次贷危机后上游地位的影响增强。对于可贸易产业,全球价值链上游地位对纯特定产业回报的负面影响明显增强。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Global Value Chain and the Changing Roles of Country and Industry Effects in International Portfolio Diversification

We find that in the upstream status of global value chain, country effects are relatively stronger than industry effects; industry effects dominate country effects downstream of the global value chain. During financial crisis, downstream in the value chain, the influence of industry effects waned and country effects rose. Moreover, for developed countries, the negative impact of the upstream status of value chain weakened considerably; the impact of upstream status strengthened for emerging markets after the subprime mortgage crisis. For tradable industries, the negative impact of global value chain upstream status on pure industry-specific returns strengthens significantly.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Complexity

综合性期刊-数学跨学科应用

CiteScore

5.80

自引率

4.30%

发文量

595

审稿时长

>12 weeks

期刊介绍:

Complexity is a cross-disciplinary journal focusing on the rapidly expanding science of complex adaptive systems. The purpose of the journal is to advance the science of complexity. Articles may deal with such methodological themes as chaos, genetic algorithms, cellular automata, neural networks, and evolutionary game theory. Papers treating applications in any area of natural science or human endeavor are welcome, and especially encouraged are papers integrating conceptual themes and applications that cross traditional disciplinary boundaries. Complexity is not meant to serve as a forum for speculation and vague analogies between words like “chaos,” “self-organization,” and “emergence” that are often used in completely different ways in science and in daily life.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: