家族企业与战略变革:家族所有权的作用

IF 7.8

3区 管理学

Q1 MANAGEMENT

引用次数: 0

摘要

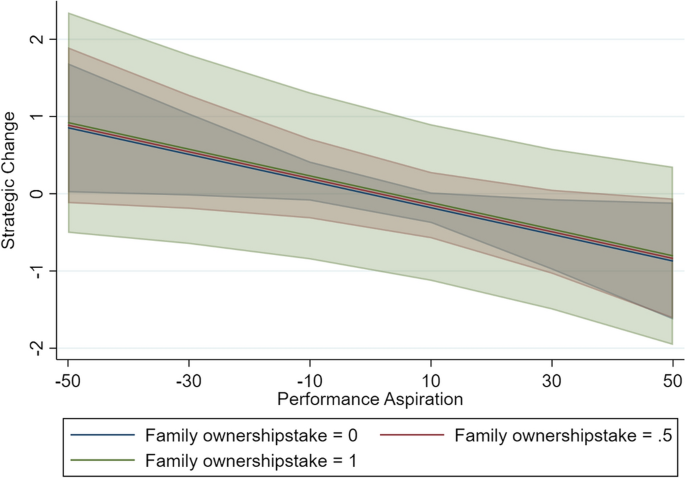

摘要本文分析了家族企业绩效期望差距对战略变革的影响,并提供了家族所有权在这一关系中的调节作用的证据。根据社会情感财富(SEW)理论,家族所有者既追求财务目标,也追求非财务目标,由于他们的个人财富与公司联系在一起,他们更倾向于规避风险,并寻求保持对公司的控制,以保持和建立他们的SEW——所有这些特征都会影响他们的战略行为。因此,我们认为,家族企业的战略决策受纯经济绩效的影响较小,而且这些企业往往更坚定地坚持其战略方向。我们以2007年至2016年间上市的欧洲公司为样本检验了我们的假设。我们的研究结果证实,企业的成功抑制了战略变革,而家族所有权通过使总体效应变小来缓和这种关系,这表明尽管存在经济陷阱,但变革的阻力更大。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Family businesses and strategic change: the role of family ownership

Abstract In this study, we analyze how the performance-aspiration gap influences strategic change in family firms, providing evidence of the moderating role of family ownership in this relationship. According to socioemotional wealth (SEW) theory, family owners pursue non-financial as well as financial goals, are more risk-averse due to their personal wealth being tied to the firm, and seek to maintain control of the firm to preserve and build their SEW—all characteristics that influence their strategic behavior. We therefore suggest that strategic decisions in family-owned firms are less influenced by purely economic performance, and that such firms tend to persevere more strongly in their strategic direction. We test our hypotheses on a sample of publicly listed European firms between 2007 and 2016. Our findings confirm that the success of firms inhibits strategic change, and that family ownership moderates this relationship by making the overall effect smaller, indicating greater resistance to change despite economic pitfalls.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Review of Managerial Science

MANAGEMENT-

CiteScore

11.30

自引率

14.50%

发文量

86

期刊介绍:

Review of Managerial Science (RMS) provides a forum for innovative research from all scientific areas of business administration. The journal publishes original research of high quality and is open to various methodological approaches (analytical modeling, empirical research, experimental work, methodological reasoning etc.). The scope of RMS encompasses – but is not limited to – accounting, auditing, banking, business strategy, corporate governance, entrepreneurship, financial structure and capital markets, health economics, human resources management, information systems, innovation management, insurance, marketing, organization, production and logistics, risk management and taxation. RMS also encourages the submission of papers combining ideas and/or approaches from different areas in an innovative way. Review papers presenting the state of the art of a research area and pointing out new directions for further research are also welcome. The scientific standards of RMS are guaranteed by a rigorous, double-blind peer review process with ad hoc referees and the journal´s internationally composed editorial board.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: