金融与地方经济增长:来自中国的新证据

IF 2.8

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

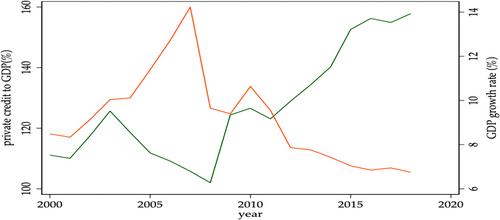

我们以 2009 年至 2018 年的 275 个中国城市为样本,研究了金融与经济增长之间的关系。我们剔除了银行通过地方政府融资工具(LGFV)向地方政府发放的贷款,并构建了一个更好的金融发展指数,该指数衡量银行向企业和家庭发放贷款的水平。我们发现,贷款与 GDP 之比越高的金融发展水平越低,经济增长也就越低。金融与经济增长之间的这种负相关关系可归因于多种机制,包括银行贷款歧视、房地产市场泡沫以及实体和金融部门之间的增长失衡。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Finance and local economic growth: New evidence from China

We study the relationship between finance and growth using a sample of 275 Chinese cities from 2009 to 2018. We exclude bank loans to local governments through the local government financing vehicles (LGFVs) and construct a better financial development index which measures the level of loans extended by banks to enterprises and households. We find that financial development in the form of a higher loan-to-GDP ratio leads to lower economic growth. This negative relationship between finance and growth may be attributed to various mechanisms, including discrimination in bank lending, housing market bubbles, and an imbalance in growth between real and financial sectors.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

International Journal of Finance & Economics

BUSINESS, FINANCE-

CiteScore

5.70

自引率

6.90%

发文量

143

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: