欧元区的环境、社会和治理绩效与违约风险

IF 7.8

3区 管理学

Q1 MANAGEMENT

引用次数: 0

摘要

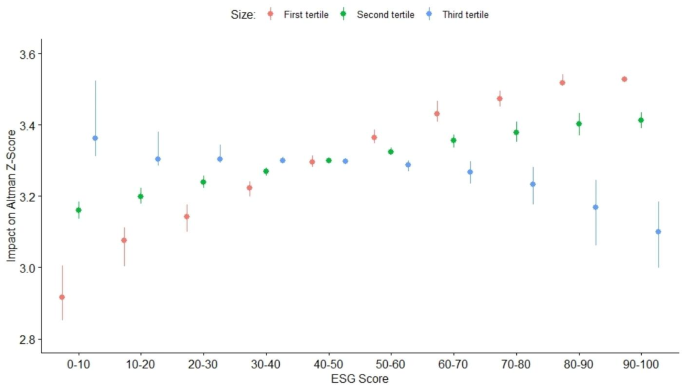

摘要本文通过ESG因素分析可持续性对违约风险的影响。样本包括2004-2020年期间欧元区的990家非金融公司。结果表明,ESG因素影响违约风险,但这种关系可能受到经济周期的影响。企业规模与ESG之间存在显著的交互作用,影响违约风险。考虑企业规模的阶级性,获得的证据表明,中小企业的高ESG得分对其违约风险具有正净效应,而在大企业中发现相反的效应。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Environmental, social, and governance perfomance and default risk in the eurozone

Abstract This paper analyses the impact of sustainability through ESG factors on the default risk. The sample consists of 990 non-financial firms in the Eurozone over the period 2004–2020. The results show that ESG factors influence default risk, although this relationship could be influenced by the economic cycle. Also, the results highlight a significant interaction effect between firm size and ESG which affects default risk. Considering firm size by terciles, the evidence obtained shows that smaller and medium-sized firms have a positive net effect of a high ESG score on their default risk, while the opposite effect was found among larger firms.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Review of Managerial Science

MANAGEMENT-

CiteScore

11.30

自引率

14.50%

发文量

86

期刊介绍:

Review of Managerial Science (RMS) provides a forum for innovative research from all scientific areas of business administration. The journal publishes original research of high quality and is open to various methodological approaches (analytical modeling, empirical research, experimental work, methodological reasoning etc.). The scope of RMS encompasses – but is not limited to – accounting, auditing, banking, business strategy, corporate governance, entrepreneurship, financial structure and capital markets, health economics, human resources management, information systems, innovation management, insurance, marketing, organization, production and logistics, risk management and taxation. RMS also encourages the submission of papers combining ideas and/or approaches from different areas in an innovative way. Review papers presenting the state of the art of a research area and pointing out new directions for further research are also welcome. The scientific standards of RMS are guaranteed by a rigorous, double-blind peer review process with ad hoc referees and the journal´s internationally composed editorial board.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: