Could “Lehman Sisters” reduce bank risk-taking? International evidence

Abstract

Research question/issue

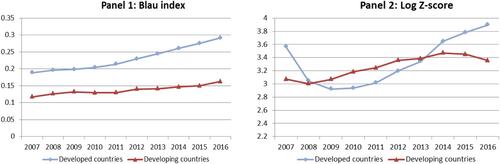

Since the global financial crisis triggered by the collapse of Lehman Brothers, board gender diversity has attracted growing attention among academia and policy makers. The “Lehman Sisters” hypothesis argues for more female representation on bank director boards based on the stereotyped gender gap in risk preference, which has been widely supported by empirical studies on nonfinancial firms. However, due to the constraint of data unavailability, empirical research on board gender diversity and bank risk-taking is relatively scarce and mostly confined to individual developed markets with inconclusive findings. In this paper, we examine the impact of board gender diversity on bank risk-taking using a large hand-collected dataset covering 480 commercial banks across 18 developed and 21 developing countries over the period 2007–2016.

Research findings/insights

We find that lower bank risk-taking is associated with greater board gender diversity, supporting the “Lehman Sisters” hypothesis in the international context; however, this effect is significantly weakened in countries with more hostile perception toward working women. We also confirm the critical threshold of three female directors to play a significant role in reducing bank risk-taking, providing novel international evidence in support of the critical mass theory from the banking sector.

Theoretical/academic implications

Our findings help to reconcile existing contradictory empirical evidence from different countries by highlighting the importance of cultural effects.

Practitioner/policy implications

We provide the first international empirical evidence in support of the policies aimed to promote representation of women on director boards, particularly in the banking sector. We confirm that a critical mass number of female directors on a bank board is important to avoid the tokenism problem. In countries with less support toward working women, policy makers also need to work on improving the overall working environment for women in order to achieve the expected outcome.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: