A reform of value-added taxes on foods can have health, environmental and economic benefits in Europe

IF 23.6

Q1 FOOD SCIENCE & TECHNOLOGY

引用次数: 0

Abstract

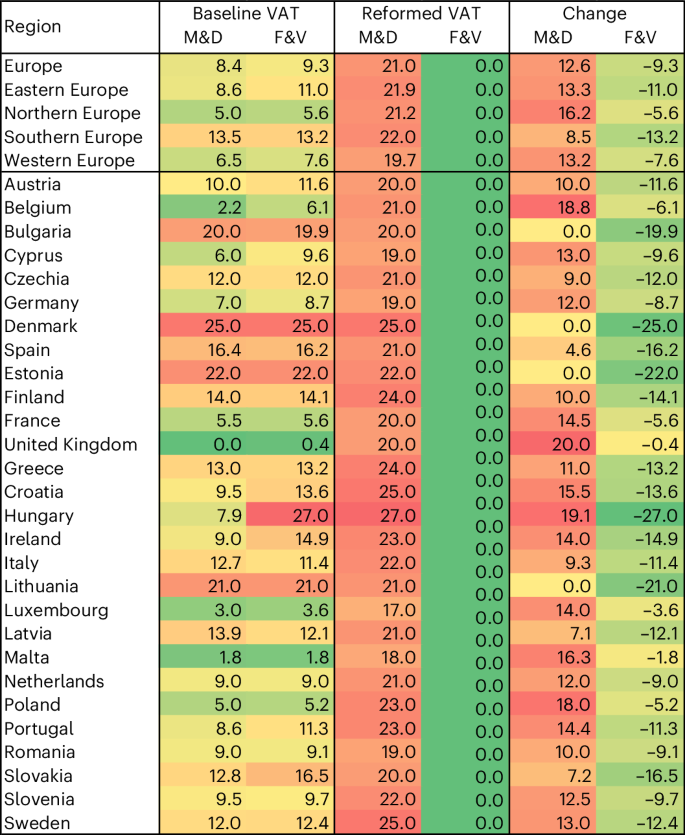

Fiscal policies can provide important incentives for encouraging the dietary changes needed to achieve global policy targets. Across Europe, the foods relevant to health and the environment often incur reduced but non-zero value-added tax (VAT) rates at about half the maximum rates, which allows for providing both incentives and disincentives. Integrating economic, health and environmental modelling, we show that reforming VAT rates on foods, including increasing rates on meat and dairy, and reducing VAT rates on fruits and vegetables can improve diets and result in health, environmental and economic benefits in most European countries. The health improvements were primarily driven by reductions in VAT rates on fruits and vegetables, whereas most of the environmental and revenue benefits were driven by increased rates on meat and dairy. Our findings suggest that differentiating VAT rates based on health and environmental considerations can support changes towards healthier and more sustainable diets in Europe. Fiscal incentives on consumption can encourage dietary changes towards healthier and more sustainable foods. Integrated modelling reveals the potential health, environmental and economic impacts of aligning VAT rates on food with health and environmental considerations in Europe.

食品增值税改革对欧洲的健康、环境和经济都有好处

财政政策可以为鼓励实现全球政策目标所需的饮食变化提供重要激励。在整个欧洲,与健康和环境有关的食品往往需要缴纳较低但非零的增值税,税率约为最高税率的一半,这样既可以提供激励措施,也可以提供抑制措施。综合经济、健康和环境模型,我们表明,在大多数欧洲国家,改革食品增值税税率,包括提高肉类和乳制品的税率,降低水果和蔬菜的增值税税率,可以改善饮食,并带来健康、环境和经济效益。健康状况的改善主要是由于水果和蔬菜增值税税率的降低,而大部分环境和收入效益是由肉类和乳制品税率的提高推动的。我们的研究结果表明,基于健康和环境考虑区分增值税税率可以支持欧洲向更健康和更可持续的饮食转变。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: