Corporate cash policy and double machine learning

IF 2.8

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

Abstract

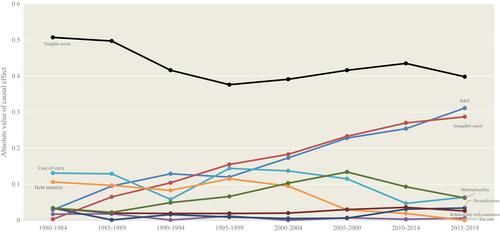

We are the first to explore the role of firm-level drivers in corporate cash policy applying cutting-edge double machine learning technique. We identify tangibility of assets and R&D spending as two main driving forces behind the cash increase when they are considered both independently and jointly. Furthermore, our findings support the relevance of the transaction cost model and the refinancing risk of long-term debt at the beginning of the sample period. In contrast, precautionary motive emerges as more pertinent in contemporary times. Our results are robust to alternative machine learners, cash proxies and estimation methods.

企业现金政策与双重机器学习

我们首次运用最前沿的双重机器学习技术探讨了企业层面的驱动因素在企业现金政策中的作用。我们发现,资产有形化和研发支出是现金增加背后的两个主要驱动因素,这两个因素既可以单独考虑,也可以共同考虑。此外,我们的研究结果还支持交易成本模型和样本期初长期债务再融资风险的相关性。相比之下,预防动机在当代显得更为重要。我们的结果对其他机器学习器、现金替代物和估计方法都是稳健的。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

International Journal of Finance & Economics

BUSINESS, FINANCE-

CiteScore

5.70

自引率

6.90%

发文量

143

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: