Refining the freeloading and no purchase behavior in pay as you wish pricing

IF 9.6

3区 管理学

Q1 MANAGEMENT

引用次数: 0

Abstract

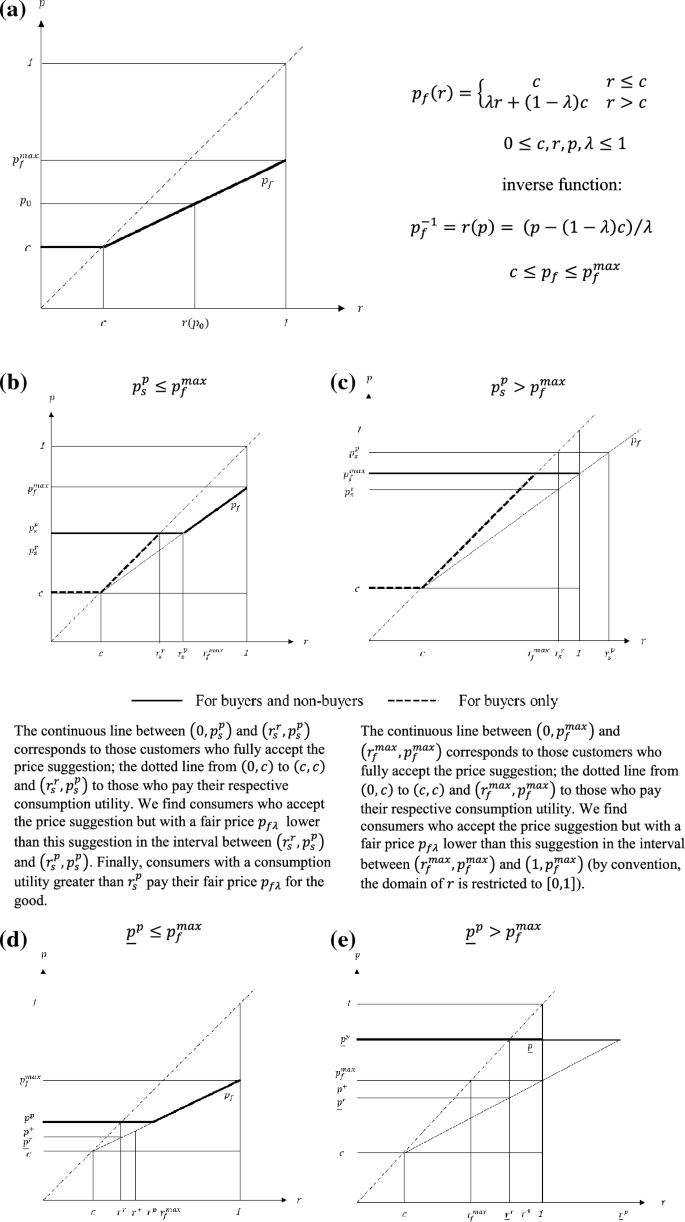

Abstract Pay as you wish (PAYW) pricing offers a radical shift from posted pricing schemes. Modeling consumer behavior under PAYW pricing promises insights into conditions under which PAYW is profitable. Firstly, this paper extends an established model that builds on inequity-averse consumers and models their behavior in PAYW as well as the seller’s profits. The paper uses a comprehensive approach to describe consumers with low fairness concerns and points to a new segment of consumers who were not considered in previous PAYW models. They are characterized by a decision not to buy a good under a PAYW pricing policy, even if they can get it for free, and are not strongly averse to advantageous inequity. Secondly, the paper discusses the profitability of PAYW with a suggested price when the seller’s ability to suggest high prices is limited. Thirdly, the paper incorporates the effect of disadvantageous inequity aversion on PAYW with a minimum price. Finally, the paper offers guidelines on how a seller should choose the optimal pricing policy.

改进了免费下载和无购买行为的支付,如你所愿的定价

按需付费(PAYW)定价提供了从发布定价方案的根本转变。在PAYW定价下对消费者行为进行建模,可以洞察PAYW盈利的条件。首先,本文扩展了一个建立在不平等厌恶消费者基础上的模型,并对他们在PAYW中的行为以及卖方的利润进行了建模。本文使用了一种综合的方法来描述对公平关注度较低的消费者,并指出了在以前的PAYW模型中没有考虑到的新消费者群体。他们的特点是决定不购买现收现付定价政策下的商品,即使他们可以免费获得,并且不强烈反对有利的不平等。其次,本文讨论了在卖方建议高价的能力有限的情况下,带建议价格的PAYW的盈利能力。第三,本文考虑了不利不平等厌恶对最低价格下PAYW的影响。最后,本文给出了卖方如何选择最优定价策略的指导原则。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Review of Managerial Science

MANAGEMENT-

CiteScore

11.30

自引率

14.50%

发文量

86

期刊介绍:

Review of Managerial Science (RMS) provides a forum for innovative research from all scientific areas of business administration. The journal publishes original research of high quality and is open to various methodological approaches (analytical modeling, empirical research, experimental work, methodological reasoning etc.). The scope of RMS encompasses – but is not limited to – accounting, auditing, banking, business strategy, corporate governance, entrepreneurship, financial structure and capital markets, health economics, human resources management, information systems, innovation management, insurance, marketing, organization, production and logistics, risk management and taxation. RMS also encourages the submission of papers combining ideas and/or approaches from different areas in an innovative way. Review papers presenting the state of the art of a research area and pointing out new directions for further research are also welcome. The scientific standards of RMS are guaranteed by a rigorous, double-blind peer review process with ad hoc referees and the journal´s internationally composed editorial board.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: