在不完美的代理中选择纠正性税收

IF 1.1

4区 经济学

Q3 ECONOMICS

引用次数: 0

摘要

选择有时会因内部性或外部性而扭曲。本文考虑了一种不能直接对这种扭曲征税的情况,并提出了政策制定者应该如何选择一个代理变量来代替征税的问题。我们推导了一个代理何时应该优先于另一个代理的标准,并考虑了对该标准有影响的一系列因素。这些因素是(i)对税率的敏感性,(ii)被征税变量接近扭曲变量的准确程度,(iii)对抵消行为的敏感性,以及(iv)消费者异质性。我们的分析是通过对含糖饮料从价税和从量税的比较来说明的。本文章由计算机程序翻译,如有差异,请以英文原文为准。

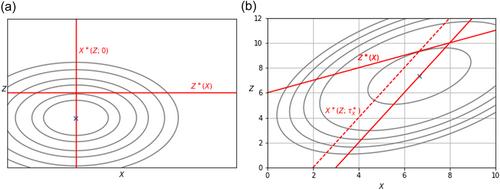

Choosing between imperfect proxies for a corrective tax

Choices are sometimes distorted by internalities or externalities. This paper considers a setting in which the distortion cannot be taxed directly, and asks how a policymaker should choose a proxy variable to tax instead. We derive a criterion for when one proxy should be preferred to another, and consider a range of factors with implications for this criterion. These factors are (i) sensitivity to the tax rate, (ii) how accurately the taxed variable approximates the distorted variable, (iii) susceptibility to offsetting behavior, and (iv) consumer heterogeneity. Our analysis is illustrated with a comparison between ad valorem and volumetric taxes on sugar-sweetened beverages.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Public Economic Theory

ECONOMICS-

自引率

36.40%

发文量

68

期刊介绍:

As the official journal of the Association of Public Economic Theory, Journal of Public Economic Theory (JPET) is dedicated to stimulating research in the rapidly growing field of public economics. Submissions are judged on the basis of their creativity and rigor, and the Journal imposes neither upper nor lower boundary on the complexity of the techniques employed. This journal focuses on such topics as public goods, local public goods, club economies, externalities, taxation, growth, public choice, social and public decision making, voting, market failure, regulation, project evaluation, equity, and political systems.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: