偏好鲁棒失真风险测度及其应用

IF 2.4

3区 经济学

Q3 BUSINESS, FINANCE

引用次数: 13

摘要

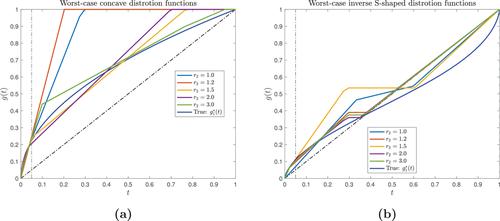

失真风险度量(DRM)在管理学和金融学特别是精算学中发挥着至关重要的作用。已经引入了各种DRM,但很少讨论应该选择手头的DRM来解决决策者(DM)的风险偏好。本文旨在填补这一空白。具体来说,我们考虑的情况是,真实失真函数未知,要么是因为很难识别/引出,要么是由于DM的风险偏好不明确。我们引入了一种偏好鲁棒失真风险度量(PRDRM),该度量基于失真函数的模糊集合中的最坏情况失真函数,以减轻模糊性带来的影响。模糊集是根据众所周知的一般原理构建的,如失真函数的凹性和反S形性(对从不可能到可能或可能到确定的事件进行加权,对从可能到更可能的事件进行减权),以及新的用户特定信息,如对尾部损失的敏感性、对某些彩票的置信区间,以及对某些彩票的偏好。为了计算所提出的PRDRM,我们使用一组点的凸和/或凹包络来表征失真函数的曲率,并在潜在随机损失离散分布时推导出PRDRM的可处理的公式。此外,我们证明了最坏情况下的失真函数是一个不退化的分段线性函数,可以通过求解线性规划问题来确定。最后,我们将所提出的PRDRM应用于一个风险资本分配问题,并进行了一些数值测试来检验PRDRM模型的有效性。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Preference robust distortion risk measure and its application

Distortion risk measure (DRM) plays a crucial role in management science and finance particularly actuarial science. Various DRMs have been introduced but little is discussed on which DRM at hand should be chosen to address a decision maker's (DM's) risk preference. This paper aims to fill out the gap. Specifically, we consider a situation where the true distortion function is unknown either because it is difficult to identify/elicit and/or because the DM's risk preference is ambiguous. We introduce a preference robust distortion risk measure (PRDRM), which is based on the worst‐case distortion function from an ambiguity set of distortion functions to mitigate the impact arising from the ambiguity. The ambiguity set is constructed under well‐known general principles such as concavity and inverse S‐shapedness of distortion functions (overweighting on events from impossible to possible or possible to certainty and underweighting on those from possible to more possible) as well as new user‐specific information such as sensitivity to tail losses, confidence intervals to some lotteries, and preferences to certain lotteries over others. To calculate the proposed PRDRM, we use the convex and/or concave envelope of a set of points to characterize the curvature of the distortion function and derive a tractable reformulation of the PRDRM when the underlying random loss is discretely distributed. Moreover, we show that the worst‐case distortion function is a nondecreasing piecewise linear function and can be determined by solving a linear programming problem. Finally, we apply the proposed PRDRM to a risk capital allocation problem and carry out some numerical tests to examine the efficiency of the PRDRM model.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Mathematical Finance

数学-数学跨学科应用

CiteScore

4.10

自引率

6.20%

发文量

27

审稿时长

>12 weeks

期刊介绍:

Mathematical Finance seeks to publish original research articles focused on the development and application of novel mathematical and statistical methods for the analysis of financial problems.

The journal welcomes contributions on new statistical methods for the analysis of financial problems. Empirical results will be appropriate to the extent that they illustrate a statistical technique, validate a model or provide insight into a financial problem. Papers whose main contribution rests on empirical results derived with standard approaches will not be considered.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: