欧洲金融机构系统性风险的组成分析

IF 0.7

Q4 BUSINESS, FINANCE

引用次数: 2

摘要

系统性风险是一个复杂而多方面的现象,需要从不同角度加以解决。在这项工作中,我们提出了一种组合数据(CoDa)方法来分析2008-2011年期间与主要欧洲国家相关的系统性风险的相对贡献分布。我们将这些国家对应的系统性风险指标表示为组成数据集的百分比份额或部分,并使用特定的CoDa程序进行多元统计分析。所提出的方法为一些变异模式和跨国关系提供了新的线索,这些变异模式和关系似乎与系统中系统风险部分的组成有关。本文章由计算机程序翻译,如有差异,请以英文原文为准。

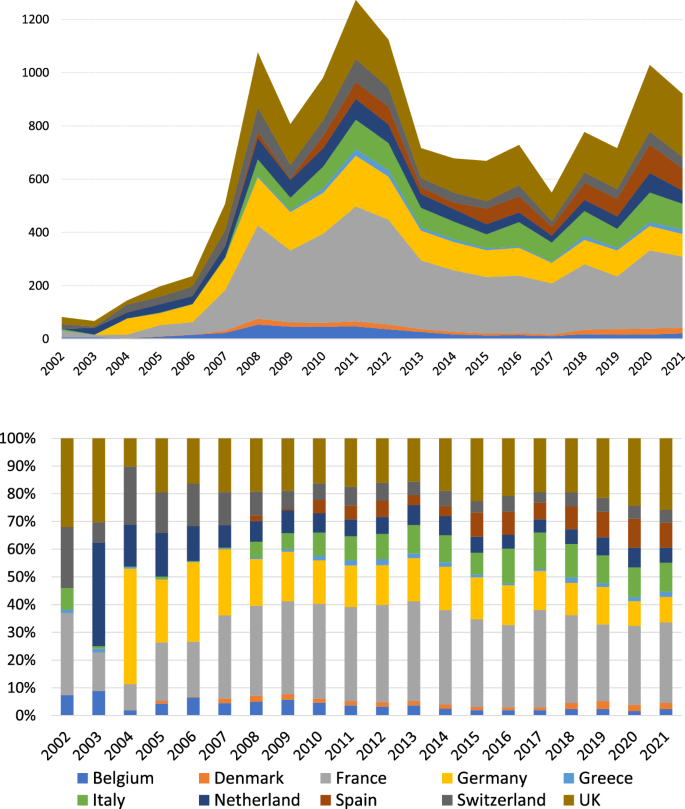

A compositional analysis of systemic risk in European financial institutions

Systemic risk is a complex and multifaceted phenomenon that needs to be addressed from different perspectives. In this work we propose a Compositional Data (CoDa) approach to analyze the distribution of relative contributions to systemic risk associated with major European countries during the period 2008–2021. We represent systemic risk measures corresponding to those countries as percentage shares, or parts, of a compositional dataset and we perform a multivariate statistical analysis using specific CoDa procedures. The proposed approach sheds new light on some variability patterns and cross-country relationships that appear to be linked to the composition of systemic risk parts in the system.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Annals of Finance

BUSINESS, FINANCE-

CiteScore

2.00

自引率

10.00%

发文量

15

期刊介绍:

Annals of Finance provides an outlet for original research in all areas of finance and its applications to other disciplines having a clear and substantive link to the general theme of finance. In particular, innovative research papers of moderate length of the highest quality in all scientific areas that are motivated by the analysis of financial problems will be considered. Annals of Finance''s scope encompasses - but is not limited to - the following areas: accounting and finance, asset pricing, banking and finance, capital markets and finance, computational finance, corporate finance, derivatives, dynamical and chaotic systems in finance, economics and finance, empirical finance, experimental finance, finance and the theory of the firm, financial econometrics, financial institutions, mathematical finance, money and finance, portfolio analysis, regulation, stochastic analysis and finance, stock market analysis, systemic risk and financial stability. Annals of Finance also publishes special issues on any topic in finance and its applications of current interest. A small section, entitled finance notes, will be devoted solely to publishing short articles – up to ten pages in length, of substantial interest in finance. Officially cited as: Ann Finance

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: