为什么大多数财富税都被放弃了?这次不同吗?

IF 2.2

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 14

摘要

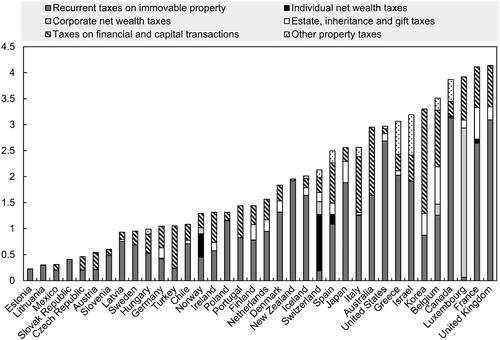

在政策和学术界,财富税正日益被视为征收额外收入和解决不平等问题的一种选择。然而,一个经常被提出的反对意见是,它们似乎在尝试过的国家失败了,近几十年来,大多数经合组织国家都放弃了财富税。本文概述了经合组织国家在财富税方面的经验,并探讨了导致大多数国家废除财富税的不同因素。本文还讨论了今天的情况是否会有所不同,以及对税收政策的影响。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Why were most wealth taxes abandoned and is this time different?

Wealth taxes are increasingly being considered as an option in policy and academic circles to collect additional revenue and address inequality. One objection that is often raised, however, is that they seem to have failed in countries that tried them, with most OECD countries abandoning their wealth taxes in recent decades. This paper gives an overview of OECD countries’ experiences with wealth taxes and explores the different factors that have led to their repeal in most countries. The paper also discusses whether the situation might be different today and what the implications for tax policy might be.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Fiscal Studies

Multiple-

CiteScore

13.50

自引率

1.40%

发文量

18

期刊介绍:

The Institute for Fiscal Studies publishes the journal Fiscal Studies, which serves as a bridge between academic research and policy. This esteemed journal, established in 1979, has gained global recognition for its publication of high-quality and original research papers. The articles, authored by prominent academics, policymakers, and practitioners, are presented in an accessible format, ensuring a broad international readership.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: