不明确的合同

IF 7.1

1区 经济学

Q1 ECONOMICS

引用次数: 0

摘要

我们探讨了在合同设计中故意注入模糊性的问题。我们的研究表明,当代理人是模糊厌恶者并因此选择使其最小效用最大化的行动时,委托人可以严格地从使用模糊合约中获得收益,而且这种收益可以任意地高。我们描述了最优模糊合约的结构,表明模糊性会促使最优合约趋于简单。我们还给出了一类防模糊合约的特征,在这类合约中,委托人无法通过注入模糊性获得收益。最后,我们证明了当代理人可以采取混合行动时,模糊合约的优势就会消失。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Ambiguous Contracts

We explore the deliberate infusion of ambiguity into the design of contracts. We show that when the agent is ambiguity-averse and hence chooses an action that maximizes their minimum utility, the principal can strictly gain from using an ambiguous contract, and this gain can be arbitrarily high. We characterize the structure of optimal ambiguous contracts, showing that ambiguity drives optimal contracts toward simplicity. We also provide a characterization of ambiguity-proof classes of contracts, where the principal cannot gain by infusing ambiguity. Finally, we show that when the agent can engage in mixed actions, the advantages of ambiguous contracts disappear.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

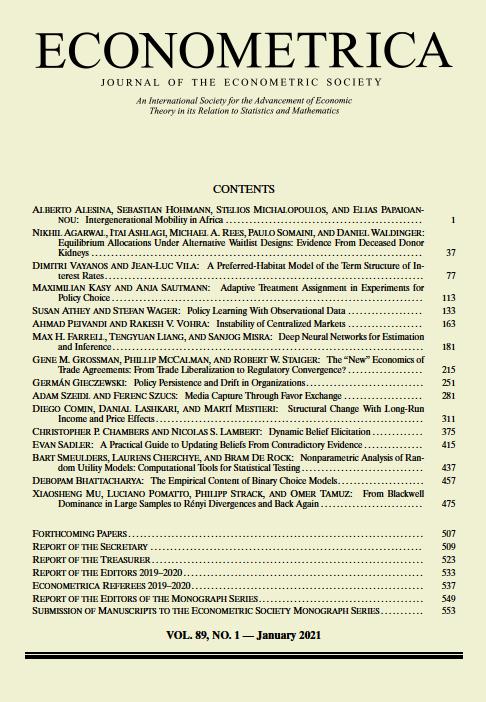

Econometrica

社会科学-数学跨学科应用

CiteScore

11.00

自引率

3.30%

发文量

75

审稿时长

6-12 weeks

期刊介绍:

Econometrica publishes original articles in all branches of economics - theoretical and empirical, abstract and applied, providing wide-ranging coverage across the subject area. It promotes studies that aim at the unification of the theoretical-quantitative and the empirical-quantitative approach to economic problems and that are penetrated by constructive and rigorous thinking. It explores a unique range of topics each year - from the frontier of theoretical developments in many new and important areas, to research on current and applied economic problems, to methodologically innovative, theoretical and applied studies in econometrics.

Econometrica maintains a long tradition that submitted articles are refereed carefully and that detailed and thoughtful referee reports are provided to the author as an aid to scientific research, thus ensuring the high calibre of papers found in Econometrica. An international board of editors, together with the referees it has selected, has succeeded in substantially reducing editorial turnaround time, thereby encouraging submissions of the highest quality.

We strongly encourage recent Ph. D. graduates to submit their work to Econometrica. Our policy is to take into account the fact that recent graduates are less experienced in the process of writing and submitting papers.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: