发达经济体应否管理国际资本流动?实证与福利分析*

IF 1.5

3区 经济学

Q2 ECONOMICS

引用次数: 0

摘要

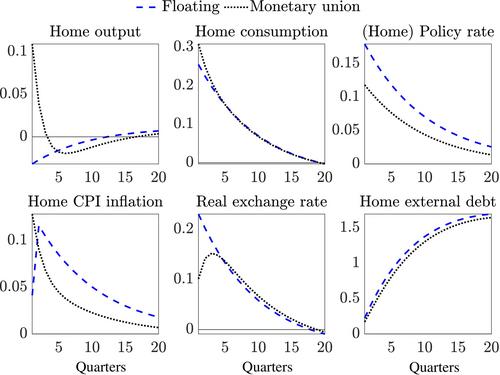

有关国家风险溢价冲击影响的文献主要集中于新兴市场经济体。我们的实证研究表明,在发达经济体中,风险溢价冲击在总体波动中所占的份额不小,是危机期间实际活动的关键驱动因素。我们的实证结果和两国新凯恩斯主义模型的结果表明,在货币联盟下,风险溢价的增加会导致总产出的减少,但在汇率灵活、货币政策独立的国家则不会出现这种情况。模型模拟表明,管理国际资本流动可提高货币联盟国家的福利。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Should Developed Economies Manage International Capital Flows? An Empirical and Welfare Analysis*

The literature on the effects of country risk premium shocks has largely focused on emerging market economies. We empirically show that in developed economies, risk premium shocks explain a non-trivial share of aggregate fluctuations and are key drivers of real activity during crises. Our empirical results and results from a two-country New Keynesian model indicate that an increase in the risk premium leads to a reduction in aggregate output under monetary union, but not so in countries with flexible exchange rates and independent monetary policy. Model simulations suggest that managing international capital flows enhances welfare in countries under monetary union.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Oxford Bulletin of Economics and Statistics

管理科学-统计学与概率论

CiteScore

5.10

自引率

0.00%

发文量

54

审稿时长

>12 weeks

期刊介绍:

Whilst the Oxford Bulletin of Economics and Statistics publishes papers in all areas of applied economics, emphasis is placed on the practical importance, theoretical interest and policy-relevance of their substantive results, as well as on the methodology and technical competence of the research.

Contributions on the topical issues of economic policy and the testing of currently controversial economic theories are encouraged, as well as more empirical research on both developed and developing countries.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: