抵押锁定、流动性和劳动力重新分配

IF 9.5

1区 经济学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

我们研究了抵押贷款利率上升对流动性和劳动力重新配置的影响。利用个人层面的信用记录数据和抵押贷款发放时间的变化,我们发现,发放时锁定的抵押贷款利率与当前利率之间的差值每下降 1 个百分点,就会使总体流动率降低 9%,在 2022 年至 2024 年期间降低 16%,而且这种关系是非对称的。抵押贷款锁定还抑制了自雇人员的流入和流出,以及对需要搬迁的附近就业机会冲击的反应能力,附近就业机会以 50 到 150 英里范围内的工资增长来衡量,并使用轮班份额工具来衡量。本文章由计算机程序翻译,如有差异,请以英文原文为准。

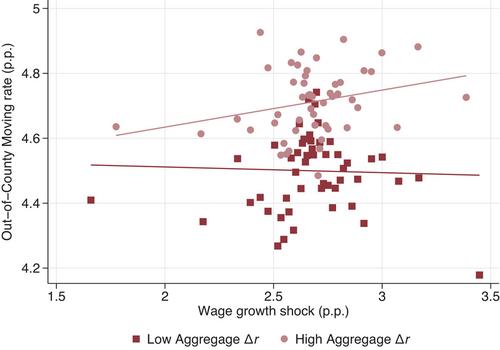

Mortgage Lock-In, Mobility, and Labor Reallocation

We study the impact of rising mortgage rates on mobility and labor reallocation. Using individual-level credit record data and variation in the timing of mortgage origination, we show that a 1 percentage point decline in the difference between mortgage rates locked in at origination and current rates reduces moving by 9% overall and 16% between 2022 and 2024, and this relationship is asymmetric. Mortgage lock-in also dampens flows in and out of self-employment and the responsiveness to shocks to nearby employment opportunities that require moving, measured as wage growth within a 50- to 150-mile ring and instrumented with a shift-share instrument.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Finance

Multiple-

CiteScore

12.90

自引率

2.50%

发文量

88

期刊介绍:

The Journal of Finance is a renowned publication that disseminates cutting-edge research across all major fields of financial inquiry. Widely regarded as the most cited academic journal in finance, each issue reaches over 8,000 academics, finance professionals, libraries, government entities, and financial institutions worldwide. Published bi-monthly, the journal serves as the official publication of The American Finance Association, the premier academic organization dedicated to advancing knowledge and understanding in financial economics. Join us in exploring the forefront of financial research and scholarship.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: