资本承诺

IF 7.6

1区 经济学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

12 万亿美元被分配给私人市场基金,这些基金要求外部投资者承诺按需转移资金。我们在一个新颖的动态投资组合分配模型中表明,事前承诺对投资者的投资组合和福利有很大影响,我们对这些影响进行了量化。投资者对私募市场基金的配置不足,他们愿意为调整承诺数量支付更高的溢价,而不是为消除其他摩擦,如时间不确定性和有限的可交易性。也许与直觉相反的是,承诺风险溢价会随着二级市场流动性的增加而增加,而且当投资分散到许多基金时,承诺风险溢价也不会消失。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Capital Commitment

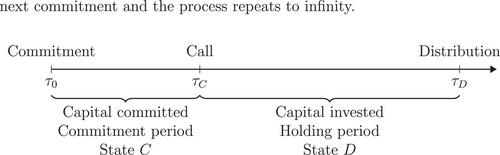

Twelve trillion dollars are allocated to private market funds that require outside investors to commit to transferring capital on demand. We show within a novel dynamic portfolio allocation model that ex-ante commitment has large effects on investors' portfolios and welfare, and we quantify those effects. Investors are underallocated to private market funds and are willing to pay a larger premium to adjust the quantity committed than to eliminate other frictions, like timing uncertainty and limited tradability. Perhaps counterintuitively, commitment risk premiums increase with secondary market liquidity, and they do not disappear when investments are spread over many funds.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Finance

Multiple-

CiteScore

12.90

自引率

2.50%

发文量

88

期刊介绍:

The Journal of Finance is a renowned publication that disseminates cutting-edge research across all major fields of financial inquiry. Widely regarded as the most cited academic journal in finance, each issue reaches over 8,000 academics, finance professionals, libraries, government entities, and financial institutions worldwide. Published bi-monthly, the journal serves as the official publication of The American Finance Association, the premier academic organization dedicated to advancing knowledge and understanding in financial economics. Join us in exploring the forefront of financial research and scholarship.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: