国库券短缺与短期资产定价

IF 7.6

1区 经济学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

我们提出了一个大金融危机(GFC)后货币市场和货币政策实施的模型。在我们的框架中,资本监管可能会阻止银行将持有准备金所产生的流动性中介给影子银行。因此,货币市场可能被分割,影子银行可获得的国库券的稀缺性是短期利差的主要驱动力。在这种情况下,当用充足的储备金换取稀缺的国库券或回购时,公开市场操作会对净流动性供应产生反向影响。我们的模型定量解释了 2010 年后回购利率、国债收益率和美联储逆回购工具使用的时间序列。本文章由计算机程序翻译,如有差异,请以英文原文为准。

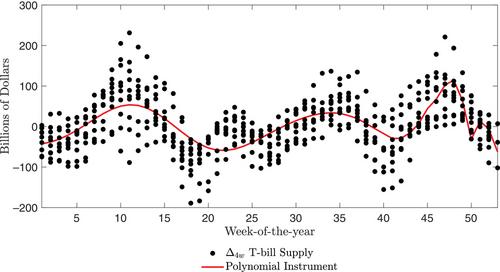

Treasury Bill Shortages and the Pricing of Short-Term Assets

We propose a model of post-Great Financial Crisis (GFC) money markets and monetary policy implementation. In our framework, capital regulation may deter banks from intermediating liquidity derived from holding reserves to shadow banks. Consequently, money markets can be segmented, and the scarcity of Treasury bills available to shadow banks is the main driver of short-term spreads. In this regime, open market operations have an inverse effect on net liquidity provision when swapping ample reserves for scarce T-bills or repos. Our model quantitatively accounts for post-2010 time series for repo rates, T-bill yields, and the Fed's reverse repo facility usage.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Finance

Multiple-

CiteScore

12.90

自引率

2.50%

发文量

88

期刊介绍:

The Journal of Finance is a renowned publication that disseminates cutting-edge research across all major fields of financial inquiry. Widely regarded as the most cited academic journal in finance, each issue reaches over 8,000 academics, finance professionals, libraries, government entities, and financial institutions worldwide. Published bi-monthly, the journal serves as the official publication of The American Finance Association, the premier academic organization dedicated to advancing knowledge and understanding in financial economics. Join us in exploring the forefront of financial research and scholarship.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: