为什么银行要求最低余额才能免收手续费?

IF 0.7

Q4 BUSINESS, FINANCE

引用次数: 0

摘要

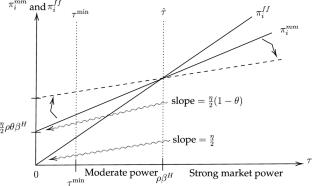

如果储户的账户余额超过一定的最低限额,美国的大型银行就会免收账户月费。本文分析了银行在何种情况下可以从这种定价策略中获益。我发现,当银行只拥有中等市场力量时,最低余额策略是有利可图的。相反,在市场力量强大的情况下,这种策略的盈利性要低于向所有储户收取月费,而不论其存款金额多少。银行的共同所有权降低了最低余额定价策略的收益。利率竞争加上收费竞争会消除这些收益。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Why do banks require minimum balance to avoid a fee?

Large banks in the United States waive their monthly account fee if depositors maintain above a certain minimum balance in their account. This article analyzes the conditions under which banks benefit from applying this pricing strategy. I find that the minimum balance strategy is profitable when banks possess only moderate market power. In contrast, under strong market power, this strategy is less profitable than charging monthly fees to all depositors regardless of their deposit amount. Common ownership of banks reduces the gains from the minimum balance pricing strategy. Interest rate competition together with fee competition eliminate these gains.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Annals of Finance

BUSINESS, FINANCE-

CiteScore

2.00

自引率

10.00%

发文量

15

期刊介绍:

Annals of Finance provides an outlet for original research in all areas of finance and its applications to other disciplines having a clear and substantive link to the general theme of finance. In particular, innovative research papers of moderate length of the highest quality in all scientific areas that are motivated by the analysis of financial problems will be considered. Annals of Finance''s scope encompasses - but is not limited to - the following areas: accounting and finance, asset pricing, banking and finance, capital markets and finance, computational finance, corporate finance, derivatives, dynamical and chaotic systems in finance, economics and finance, empirical finance, experimental finance, finance and the theory of the firm, financial econometrics, financial institutions, mathematical finance, money and finance, portfolio analysis, regulation, stochastic analysis and finance, stock market analysis, systemic risk and financial stability. Annals of Finance also publishes special issues on any topic in finance and its applications of current interest. A small section, entitled finance notes, will be devoted solely to publishing short articles – up to ten pages in length, of substantial interest in finance. Officially cited as: Ann Finance

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: