COVID-19,流动限制政策与股市波动:跨国实证研究

IF 0.9

Q3 ECONOMICS

引用次数: 0

摘要

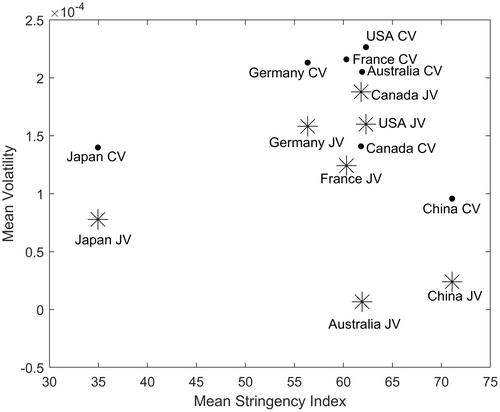

本研究探讨了 COVID-19 感染和流动限制政策对股市波动的影响。我们使用 2020 年 2 月 12 日至 2021 年 4 月 14 日的每日数据对七个国家的面板数据模型进行了估计。我们的结果表明,COVID-19 新感染病例的数量和流动性限制政策的出台在大流行期间对股市波动性的形成起着至关重要的作用。我们发现,COVID-19 新感染病例和流动限制政策会增加股市的跳跃性,而不是增加持续波动性。我们还发现,流动限制政策减轻了 COVID-19 新病例对股市波动的影响。本文章由计算机程序翻译,如有差异,请以英文原文为准。

COVID-19, Mobility Restriction Policies and Stock Market Volatility: A Cross-Country Empirical Study

This study investigates the impact of COVID-19 infections and mobility restriction policies on stock market volatility. We estimate panel data models for seven countries using daily data from February 12, 2020 to April 14, 2021. Our results show that the number of new cases of COVID-19 infections and the introduction of mobility restriction policies plays a crucial role in shaping stock market volatility during the pandemic. We found that new cases of COVID-19 infections and mobility restrictions policies increase stock market jumps rather than increase continuous volatility. We also find that mobility restriction policies lessen the impact of new COVID-19 cases on stock market volatility.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Economic Papers

ECONOMICS-

CiteScore

2.30

自引率

0.00%

发文量

23

期刊介绍:

Economic Papers is one of two journals published by the Economics Society of Australia. The journal features a balance of high quality research in applied economics and economic policy analysis which distinguishes it from other Australian journals. The intended audience is the broad range of economists working in business, government and academic communities within Australia and internationally who are interested in economic issues related to Australia and the Asia-Pacific region. Contributions are sought from economists working in these areas and should be written to be accessible to a wide section of our readership. All contributions are refereed.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: