市场力量与收入差距:企业如何影响资本与劳动收入之间的差距

IF 1.2

4区 经济学

Q3 ECONOMICS

引用次数: 0

摘要

本文研究了市场力量对收入差距的影响,同时考虑了企业的特定参数,以检验它们如何通过定价决策来形成资本和劳动收入之间的差距。数据集包括 2010-2019 年间的 2895 家英国制造业和服务业公司。结果提供了以下启示:(a) 市场力量与整个市场的收入差距之间存在很强的正相关性;(b) 流动性约束对基于资产的差距比率产生积极影响,但对基于利润的比率产生消极影响。如果将特定市场的特征纳入研究过程中,结果的稳健性也会得到检验。本文章由计算机程序翻译,如有差异,请以英文原文为准。

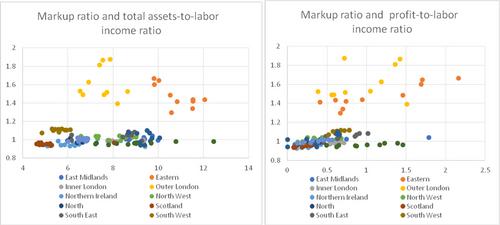

Market power and income disparities: How can firms influence the gap between capital and labor earnings

This paper investigates the effects of market power on income disparities when firm-specific parameters are considered to test how they shape the gap between capital and labor earnings through their pricing decisions. The dataset consists of 2895 UK manufacturing and services firms over 2010–2019. The results provide the following insights: (a) There is a strong positive association between market power and income disparities across the market, (b) liquidity constraints exert a positive effect on the asset-based disparities ratio, but a negative effect on the profit-based ratio. The robustness of the results is also checked when market-specific characteristics are included in the process.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Bulletin of Economic Research

ECONOMICS-

CiteScore

1.40

自引率

0.00%

发文量

56

期刊介绍:

The Bulletin of Economic Research is an international journal publishing articles across the entire field of economics, econometrics and economic history. The Bulletin contains original theoretical, applied and empirical work which makes a substantial contribution to the subject and is of broad interest to economists. We welcome submissions in all fields and, with the Bulletin expanding in new areas, we particularly encourage submissions in the fields of experimental economics, financial econometrics and health economics. In addition to full-length articles the Bulletin publishes refereed shorter articles, notes and comments; authoritative survey articles in all areas of economics and special themed issues.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: