您的想法(子)一分钱:跟踪 TAQ 的散户投资者活动

IF 7.6

1区 经济学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

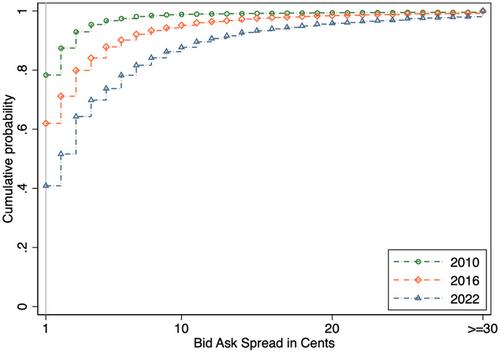

从 2021 年 12 月到 2022 年 6 月,我们在六个零售经纪账户中进行了 85,000 笔零售交易,以验证 Boehmer 等人的算法,该算法使用亚笔交易价格来识别和签署零售交易。该算法将 35% 的交易识别为零售交易,错误地签署了 28% 的识别交易,并对 30% 的股票进行了无信息的订单不平衡测量。我们修改了算法,使用报价价差中点来签署交易。报价中点法不会影响识别率,但会将签约错误率降至 5%,并为所有股票提供信息丰富的订单不平衡度量。本文章由计算机程序翻译,如有差异,请以英文原文为准。

A (Sub)penny for Your Thoughts: Tracking Retail Investor Activity in TAQ

We placed 85,000 retail trades in six retail brokerage accounts from December 2021 to June 2022 to validate the Boehmer et al. algorithm, which uses subpenny trade prices to identify and sign retail trades. The algorithm identifies 35% of our trades as retail, incorrectly signs 28% of identified trades, and yields uninformative order imbalance measures for 30% of stocks. We modify the algorithm by signing trades using the quoted spread midpoints. The quote midpoint method does not affect identification rates but reduces the signing error rates to 5% and provides informative order imbalance measures for all stocks.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Finance

Multiple-

CiteScore

12.90

自引率

2.50%

发文量

88

期刊介绍:

The Journal of Finance is a renowned publication that disseminates cutting-edge research across all major fields of financial inquiry. Widely regarded as the most cited academic journal in finance, each issue reaches over 8,000 academics, finance professionals, libraries, government entities, and financial institutions worldwide. Published bi-monthly, the journal serves as the official publication of The American Finance Association, the premier academic organization dedicated to advancing knowledge and understanding in financial economics. Join us in exploring the forefront of financial research and scholarship.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: