长期风险真的定价了吗?重新审视刘和马蒂斯(2022 年)

IF 7.6

1区 经济学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

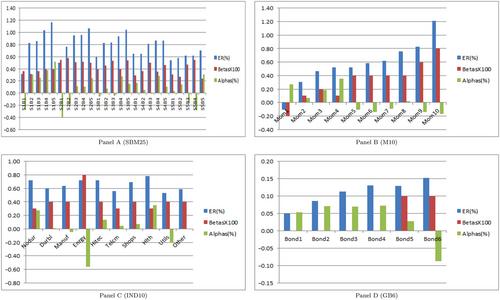

Liu 和 Matthies(LM)声称他们的宏观新闻风险因子(NI)为 51 个投资组合(与四个不同的投资组合组相关)定价,这种说法并不恰当。事实上,他们的单因子模型只成功地解释了动量十分位数,而对其余组别产生了强烈的负面表现。在另类新闻因子(HNI)的情况下,由于没有确定相应的风险价格,其定价性能更令人怀疑。LM 的结论源于对经验选择的质疑和对结果的误读。此外,NI 模型无法解释其研究中未考虑的突出的资本资产定价模型异常现象。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Is Long-Run Risk Really Priced? Revisiting Liu and Matthies (2022)

The claim by Liu and Matthies (LM) that their macro news risk factor (NI) prices 51 portfolios (associated with four different portfolio groups) is not appropriate. In fact, their single-factor model is successful only in explaining the momentum deciles, while producing strongly negative performance for the remaining groups. The pricing performance is more doubtful in the case of the alternative news factor (HNI), as the respective risk price is not identified. LM's conclusions stem from a combination of questionable empirical choices and misinterpretation of their results. Moreover, the NI model cannot explain prominent capital asset pricing model anomalies not considered in their study.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Finance

Multiple-

CiteScore

12.90

自引率

2.50%

发文量

88

期刊介绍:

The Journal of Finance is a renowned publication that disseminates cutting-edge research across all major fields of financial inquiry. Widely regarded as the most cited academic journal in finance, each issue reaches over 8,000 academics, finance professionals, libraries, government entities, and financial institutions worldwide. Published bi-monthly, the journal serves as the official publication of The American Finance Association, the premier academic organization dedicated to advancing knowledge and understanding in financial economics. Join us in exploring the forefront of financial research and scholarship.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: