金融不确定性能否预测股市总回报?

Q1 Economics, Econometrics and Finance

引用次数: 0

摘要

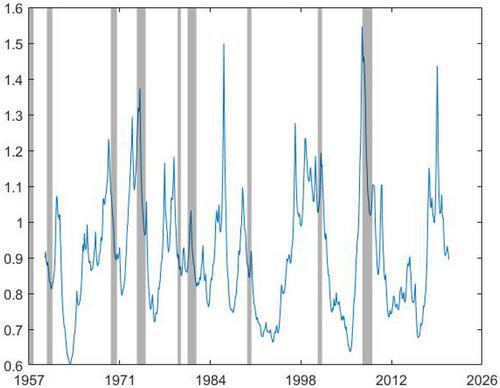

我们研究了金融不确定性在预测股市总回报中的作用。我们的研究结果表明,与文献中常用的 14 个宏观经济预测因子相比,金融不确定性及其变化对美国股市月度超额收益的预测作用更强。金融不确定性的表现优于利空因素,而利空因素被认为是股票风险溢价的最强预测因素。使用稳健的计量经济学方法进行样本内预测和样本外预测时,这些结果依然存在。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Can financial uncertainty forecast aggregate stock market returns?

We investigate the role of financial uncertainty in forecasting aggregate stock market returns. Our results suggest that financial uncertainty, along with its change, are more powerful predictors of excess US monthly stock market returns than 14 macroeconomic predictors commonly used in the literature. Financial uncertainty is shown to outperform short interest, which has been suggested to be the strongest known predictor of the equity risk premium. These results persist using robust econometric methods in-sample, and when forecasting out-of-sample.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Financial Markets, Institutions and Instruments

Economics, Econometrics and Finance-Economics, Econometrics and Finance (all)

CiteScore

1.80

自引率

0.00%

发文量

17

期刊介绍:

Financial Markets, Institutions and Instruments bridges the gap between the academic and professional finance communities. With contributions from leading academics, as well as practitioners from organizations such as the SEC and the Federal Reserve, the journal is equally relevant to both groups. Each issue is devoted to a single topic, which is examined in depth, and a special fifth issue is published annually highlighting the most significant developments in money and banking, derivative securities, corporate finance, and fixed-income securities.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: