基于独立性标准的面板结构向量自回归模型的统计识别

IF 2.3

3区 经济学

Q2 ECONOMICS

引用次数: 0

摘要

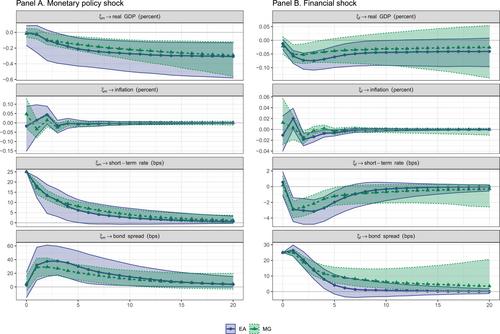

摘要 本文介绍了一种新颖的面板结构向量自回归分析方法。为了进行识别,我们在集合水平上规定了结构创新的独立性。我们通过模拟实验证明了该方法在横截面相关性和异质性条件下的稳健性。在一项关于欧元区货币政策传导的实证应用中,我们发现在货币政策意外紧缩后,债券利差会显著上升。此外,中央银行还能抵消不利金融冲击的影响。此外,我们还记录了各国产出反应的显著异质性。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Statistical identification in panel structural vector autoregressive models based on independence criteria

This paper introduces a novel panel approach to structural vector autoregressive analysis. For identification, we impose independence of structural innovations at the pooled level. We demonstrate robustness of the method under cross-sectional correlation and heterogeneity through simulation experiments. In an empirical application on monetary policy transmission in the Euro area, we find that bond spreads rise significantly after an unexpected monetary tightening. Furthermore, the central bank responds to offset effects of adverse financial shocks. Additionally, we document sizable heterogeneity in country-specific output responses.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Applied Econometrics

Multiple-

CiteScore

3.70

自引率

4.80%

发文量

63

期刊介绍:

The Journal of Applied Econometrics is an international journal published bi-monthly, plus 1 additional issue (total 7 issues). It aims to publish articles of high quality dealing with the application of existing as well as new econometric techniques to a wide variety of problems in economics and related subjects, covering topics in measurement, estimation, testing, forecasting, and policy analysis. The emphasis is on the careful and rigorous application of econometric techniques and the appropriate interpretation of the results. The economic content of the articles is stressed. A special feature of the Journal is its emphasis on the replicability of results by other researchers. To achieve this aim, authors are expected to make available a complete set of the data used as well as any specialised computer programs employed through a readily accessible medium, preferably in a machine-readable form. The use of microcomputers in applied research and transferability of data is emphasised. The Journal also features occasional sections of short papers re-evaluating previously published papers. The intention of the Journal of Applied Econometrics is to provide an outlet for innovative, quantitative research in economics which cuts across areas of specialisation, involves transferable techniques, and is easily replicable by other researchers. Contributions that introduce statistical methods that are applicable to a variety of economic problems are actively encouraged. The Journal also aims to publish review and survey articles that make recent developments in the field of theoretical and applied econometrics more readily accessible to applied economists in general.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: