经济机构在债务与增长关系中的影响:尼日利亚的证据

IF 1

4区 经济学

Q2 ECONOMICS

引用次数: 0

摘要

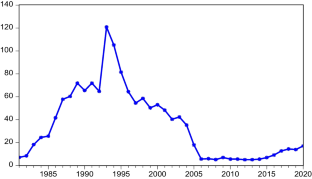

本文研究了经济体制在债务与增长关系中的影响。本文利用 1970 年至 2020 年尼日利亚的数据,通过采用考虑结构断裂的协整技术,对计量经济学文献进行了扩展。研究发现,债务、增长、经济体制和相关变量之间存在长期均衡关系。研究发现,债务对经济增长的影响在短期和长期分别达到国内生产总值的 13.62% 和 27.19% 的临界值时为正,超过这一临界值后,其影响变为负且显著。与债务相比,经济增长对经济体制更为敏感,这凸显了经济体制的重要性。本文章由计算机程序翻译,如有差异,请以英文原文为准。

The Influence of Economic Institutions in the Debt-Growth Nexus: Evidence from Nigeria

This paper investigates the influence of economic institutions in the debt-growth nexus. Using data from 1970 to 2020 on Nigeria, the paper extends the econometric literature by deploying cointegration techniques that account for structural breaks. A long equilibrium relationship was found among debt, growth, economic institutions and associated variables. The effect of debt on growth was found to be positive up to a threshold of 13.62% and 27.19% of gross domestic product in the short and long-run respectively, beyond which its effect becomes negative and significant. Growth is more sensitive to economic institutions than debt, underscoring the criticality of institutions.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Open Economies Review

ECONOMICS-

CiteScore

2.30

自引率

16.70%

发文量

40

期刊介绍:

The topics covered in Open Economies Review include, but are not limited to, models and applications of (1) trade flows, (2) commercial policy, (3) adjustment mechanism to external imbalances, (4) exchange rate movements, (5) alternative monetary regimes, (6) real and financial integration, (7) monetary union, (8) economic development and (9) external debt. Open Economies Review welcomes original manuscripts, both theoretical and empirical, dealing with international economic issues or national economic issues that have transnational relevance. Furthermore, Open Economies Review solicits contributions bearing on specific events on important branches of the literature. Open Economies Review is open to any and all contributions, without preferences for any particular viewpoint or school of thought. Open Economies Review encourages interdisciplinary communication and interaction among researchers in the vast area of international and transnational economics. Authors will be expected to meet the scientific standards prevailing in their respective fields, and empirical findings must be reproducible. Regardless of degree of complexity and specificity, authors are expected to write an introduction, setting forth the nature of their research and the significance of their findings, in a manner accessible to researchers in other disciplines. Officially cited as: Open Econ Rev

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: