规范具有网络外部性的市场中的平台竞争:限制掠夺性定价能否增加社会福利?

IF 1

4区 经济学

Q3 BUSINESS, FINANCE

引用次数: 0

摘要

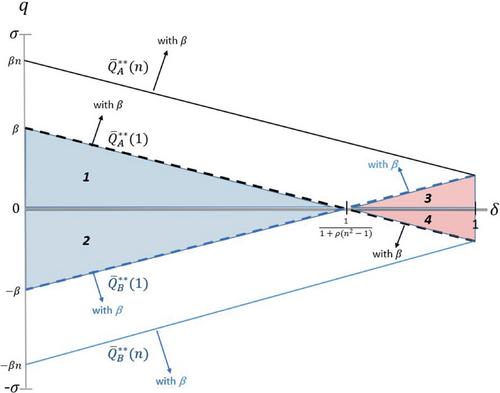

我们考虑的是一个具有网络外部性的市场中无限重复的平台竞争。上一时期主导市场的平台在这一时期成为现任者。我们研究了禁止两个平台(对称监管)或只禁止在位者(非对称监管)收取掠夺性价格的反垄断政策的效果。我们发现,对称监管会减少消费者剩余,但不会影响效率。当市场规模长期保持不变时,非对称监管会增加消费者剩余并提高福利。然而,当市场规模随时间变化时,这种政策可能会导致无效率的进入。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Regulating Platform Competition in Markets with Network Externalities: Will Predatory Pricing Restrictions Increase Social Welfare?*

We consider an infinitely repeated platform competition in a market with network externalities. The platform that dominated the market in the previous period becomes the incumbent in the current period. We examine the effect of an antitrust policy that prohibits both platforms (symmetric regulation), or just the incumbent (asymmetric regulation) from charging predatory prices. We show that symmetric regulation decreases consumer surplus and does not affect efficiency. Asymmetric regulation increases consumer surplus and improves welfare when the size of the market remains constant over time. Yet, when market size varies over time, this policy may lead to inefficient entry.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Industrial Economics

Multiple-

CiteScore

1.60

自引率

0.00%

发文量

27

期刊介绍:

First published in 1952, the Journal of Industrial Economics has a wide international circulation and is recognised as a leading journal in the field. It was founded to promote the analysis of modern industry, particularly the behaviour of firms and the functioning of markets. Contributions are welcomed in all areas of industrial economics including: - organization of industry - applied oligopoly theory - product differentiation and technical change - theory of the firm and internal organization - regulation - monopoly - merger and technology policy Necessarily, these subjects will often draw on adjacent areas such as international economics, labour economics and law.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: