全天候外汇定价和回报

IF 7.6

1区 经济学

Q1 BUSINESS, FINANCE

引用次数: 0

摘要

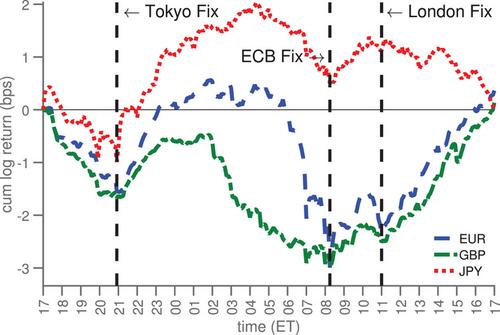

美元在外汇定价前升值,定价后贬值,昼夜呈现 W 型回报模式。在 21 年的时间里,交易量最大的九种货币的回报率反转非常普遍,而且在统计上非常显著,根据即期交易量计算,这意味着每天的波动超过 10 亿美元。通过自然实验,我们证明了已公布参考汇率的存在决定了日内回报逆转的时间。我们提出的证据与库存风险的解释相一致,即外汇交易商在定盘价上对美元的中间需求是无条件的。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Foreign Exchange Fixings and Returns around the Clock

The U.S. dollar appreciates in the run-up to foreign exchange (FX) fixes and depreciates thereafter, tracing a W-shaped return pattern around the clock. Return reversals for the top nine traded currencies over a 21-year period are pervasive and highly statistically significant, and they imply daily swings of more than one billion U.S. dollars based on spot volumes. Using natural experiments, we document the existence of a published reference rate determines the timing of intraday return reversals. We present evidence consistent with an inventory risk explanation whereby FX dealers intermediate unconditional demand for U.S. dollars at the fixes.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

Journal of Finance

Multiple-

CiteScore

12.90

自引率

2.50%

发文量

88

期刊介绍:

The Journal of Finance is a renowned publication that disseminates cutting-edge research across all major fields of financial inquiry. Widely regarded as the most cited academic journal in finance, each issue reaches over 8,000 academics, finance professionals, libraries, government entities, and financial institutions worldwide. Published bi-monthly, the journal serves as the official publication of The American Finance Association, the premier academic organization dedicated to advancing knowledge and understanding in financial economics. Join us in exploring the forefront of financial research and scholarship.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: