Infinite Debt Rollover in Stochastic Economies

IF 6.6

1区 经济学

Q1 ECONOMICS

引用次数: 0

Abstract

This paper shows that there is more scope for a borrower to engage in a sustainable infinite debt rollover (a “Ponzi scheme”) when interest/growth rates are stochastic. In this context, I prove that the relevant “r vs. g” comparison uses the yield rlong to an infinite-maturity zero-coupon bond. I show that rlong is lower than the risk-neutral expectation of the short-term yield when it is variable, and that rlong is close to the minimal realization of the short-term yield when it is highly persistent. The paper applies these results to illustrative heterogeneous agent dynamic stochastic general equilibrium models to obtain similarly weakened sufficient conditions for the existence of public debt bubbles.

随机经济中的无限债务展期

本文表明,当利率/增长率是随机的时,借款人有更大的空间进行可持续的无限债务展期(“庞氏骗局”)。在这种情况下,我证明了相关的“r与g”比较使用了无限期零息债券的收益率rlong。我证明了当rlong是可变的时,它低于短期收益率的风险中性预期,并且当它是高度持久的时,rlong接近短期收益的最小实现。本文将这些结果应用于说明性的异质主体动态随机一般均衡模型,得到了公共债务泡沫存在的类似弱化的充分条件。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

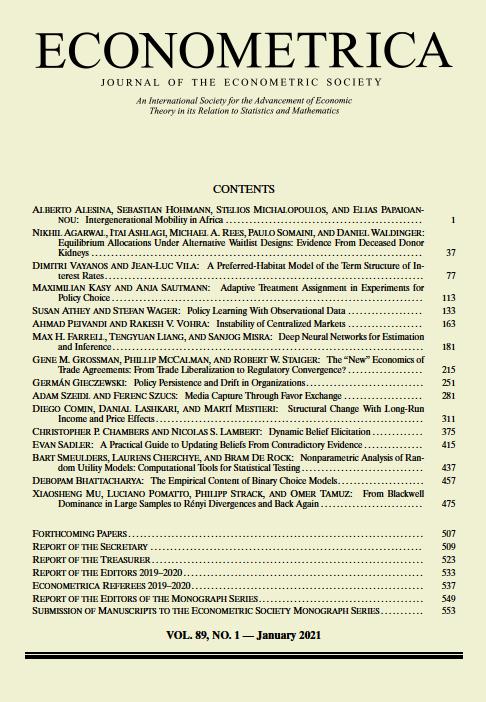

Econometrica

社会科学-数学跨学科应用

CiteScore

11.00

自引率

3.30%

发文量

75

审稿时长

6-12 weeks

期刊介绍:

Econometrica publishes original articles in all branches of economics - theoretical and empirical, abstract and applied, providing wide-ranging coverage across the subject area. It promotes studies that aim at the unification of the theoretical-quantitative and the empirical-quantitative approach to economic problems and that are penetrated by constructive and rigorous thinking. It explores a unique range of topics each year - from the frontier of theoretical developments in many new and important areas, to research on current and applied economic problems, to methodologically innovative, theoretical and applied studies in econometrics.

Econometrica maintains a long tradition that submitted articles are refereed carefully and that detailed and thoughtful referee reports are provided to the author as an aid to scientific research, thus ensuring the high calibre of papers found in Econometrica. An international board of editors, together with the referees it has selected, has succeeded in substantially reducing editorial turnaround time, thereby encouraging submissions of the highest quality.

We strongly encourage recent Ph. D. graduates to submit their work to Econometrica. Our policy is to take into account the fact that recent graduates are less experienced in the process of writing and submitting papers.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: