Boots on the ground: Foreign direct investment by born digital firms

Abstract

Research Summary

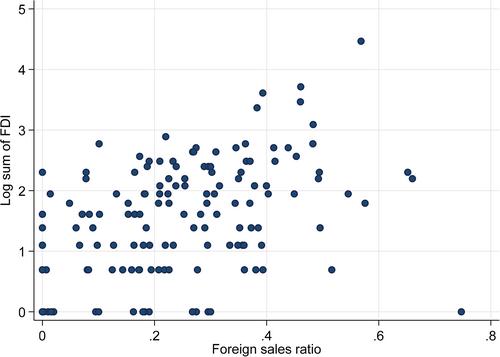

Recent global strategy research on born digital firms (i.e., firms with digital products distributed through digital channels) has paid only limited attention to the role of foreign direct investment (FDI) in the internationalization of such firms. We argue that exploiting digital technologies requires a range of complementary, non-digital resources. Born digitals typically deploy FDI when large cultural and geographic distances limit the fungibility and scalability of such complementary resources, leading to a positive relationship between distance (cultural and geographic) and FDI. The positive distance effect is moderated by business model type. Using a sample of US-based born digital firms with over 800 FDIs, we find support for our hypotheses and contribute an important empirical baseline to recent discussions of digitalization in global strategy.

Managerial Summary

Companies selling digital products (e.g., software, cloud-based services) are theoretically able to offer their products in foreign markets through internet-based channels, without ever setting foot in a foreign country. And yet, many “born digital” firms establish a physical presence in foreign markets by undertaking foreign direct investment (FDI). This phenomenon remains insufficiently explained. We argue that FDI can supply important complementary resources that help exploit and monetize digital assets in foreign markets. Using data from over 800 FDI projects, we show that FDI is more likely to occur if the foreign market is far away or culturally very different from the company's home country, and that the strength of this relationship differs among B2C and B2B business models.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: