Not your average firm: A quantile regression approach to firm-level investment in the United States

IF 1

3区 经济学

Q3 ECONOMICS

引用次数: 0

Abstract

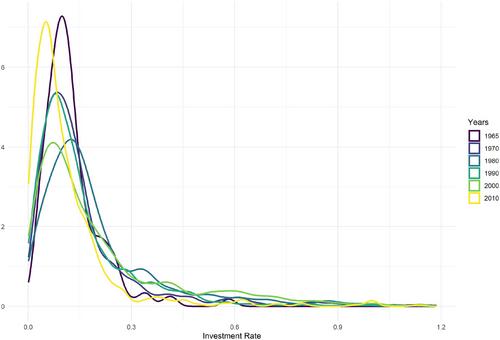

A significant portion of the work published on firm investment adapts models that operate on an “average firm” assumption, which is different from the investment behavior of a modal firm. This study employs a Bayesian quantile regression model to explore the investment rates in the United States and finds, first, that the firms with higher investment rates have a higher responsiveness to the valuation ratio and lower responsiveness to the profit rate, and, second, that there is a decline in the responsiveness of firm investment to these factors in recent years. The paper also emphasizes the role of autonomous investments in determining firm-level investment rates, based on differing sectoral factors.

不是你的普通公司:美国公司级投资的分位数回归方法

发表的关于企业投资的研究中,有很大一部分采用了基于“平均企业”假设的模型,这与模式企业的投资行为不同。本研究采用贝叶斯分位数回归模型来探索美国的投资率,发现:首先,投资率较高的公司对估值比率的响应较高,对利润率的响应较低;其次,近年来公司投资对这些因素的响应有所下降。该文件还强调了自主投资在基于不同行业因素确定公司层面投资率方面的作用。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: