Drawdown risk measures for asset portfolios with high frequency data

IF 0.7

Q4 BUSINESS, FINANCE

引用次数: 0

Abstract

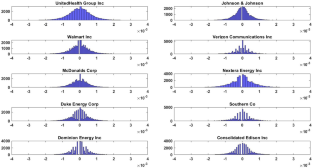

In this paper, we analyze Drawdown-based risk measures for an equity portfolio with high-frequency data. The returns of individual stocks are modeled through multivariate weighted-indexed semi-Markov chains with a copula dependence structure. Through this recently published model, we show that the estimate of Drawdown-based risk measures is more faithful than that obtained with the application of classic econometric models.

具有高频数据的资产组合的回撤风险度量

在本文中,我们分析了具有高频数据的股票投资组合的基于提款的风险度量。通过具有copula依赖结构的多变量加权指数半马尔可夫链对个股的收益进行建模。通过这个最近发表的模型,我们表明,基于提款的风险度量的估计比应用经典计量经济学模型获得的估计更可靠。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Annals of Finance

BUSINESS, FINANCE-

CiteScore

2.00

自引率

10.00%

发文量

15

期刊介绍:

Annals of Finance provides an outlet for original research in all areas of finance and its applications to other disciplines having a clear and substantive link to the general theme of finance. In particular, innovative research papers of moderate length of the highest quality in all scientific areas that are motivated by the analysis of financial problems will be considered. Annals of Finance''s scope encompasses - but is not limited to - the following areas: accounting and finance, asset pricing, banking and finance, capital markets and finance, computational finance, corporate finance, derivatives, dynamical and chaotic systems in finance, economics and finance, empirical finance, experimental finance, finance and the theory of the firm, financial econometrics, financial institutions, mathematical finance, money and finance, portfolio analysis, regulation, stochastic analysis and finance, stock market analysis, systemic risk and financial stability. Annals of Finance also publishes special issues on any topic in finance and its applications of current interest. A small section, entitled finance notes, will be devoted solely to publishing short articles – up to ten pages in length, of substantial interest in finance. Officially cited as: Ann Finance

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: