Interbank market and funding liquidity risk in a stock-flow consistent model

IF 1

3区 经济学

Q3 ECONOMICS

引用次数: 3

Abstract

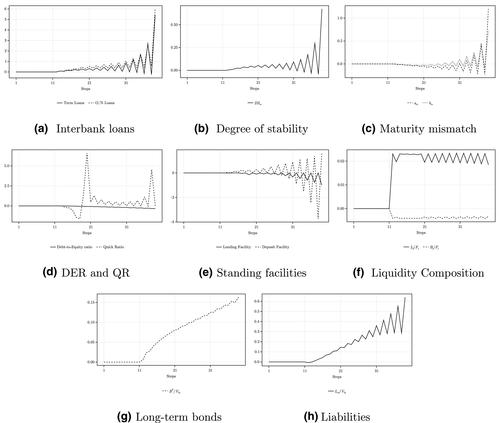

The present stock-flow consistent model aims at capturing the second causal link of endogenous monetary theory, from deposits to reserves, by including intrasectoral flows within the banking sector and debt maturity structure decisions. For this purpose, banks can choose the demanded duration of interbank loans, either overnight or term, according to a measure for maturity mismatch which captures funding liquidity risk. The simulations show that: (i) a well-functioning term interbank market is needed when banks face exogenous shocks; and (ii) banks’ funding structure may act as an endogenous source of credit market pressures.

银行间市场和资金流动性风险在股票流动一致性模型

目前的股票流动一致模型旨在通过将银行部门内流动和债务期限结构决定包括在内,捕捉从存款到储备的内生货币理论的第二个因果联系。为此,银行可以根据捕获资金流动性风险的期限错配度量来选择银行间贷款的需求期限,无论是隔夜贷款还是定期贷款。模拟结果表明:(1)当银行面临外生冲击时,需要一个运作良好的银行间期限市场;(二)银行的融资结构可能成为信贷市场压力的内生来源。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: