Financial and trade relationships between the Eurozone and China in the age of resilience

Abstract

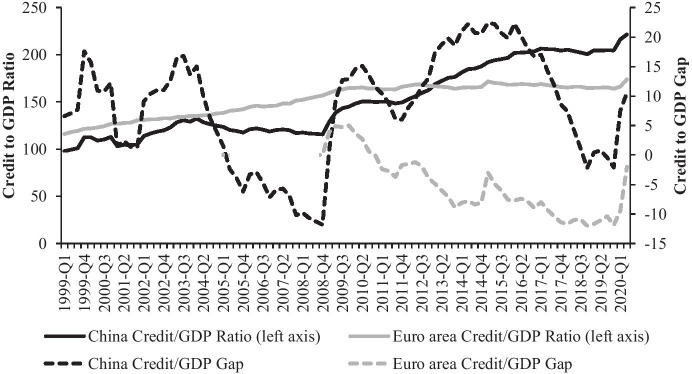

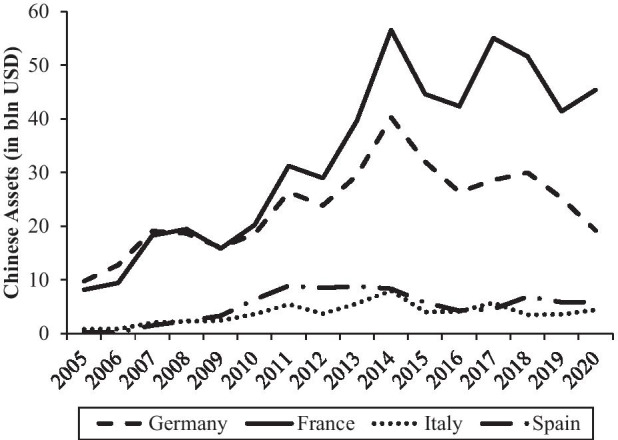

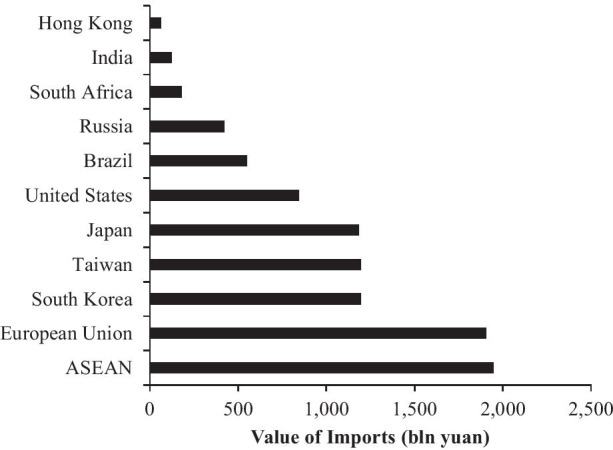

How did the financial and trade ties between China and the Eurozone develop in the aftermath of the Eurozone sovereign debt crisis? We analyze these trends until the start of the COVID-19 pandemic. Using data from the Bank of International Settlements (BIS) and the International Monetary Fund (IMF), we examine the financial and trade dynamics between the two currency areas and analyze the related risks and opportunities. The data point to several patterns. We find that financial volatility in China has been substantially greater than in the Eurozone. Even so, the largest and strongest Eurozone economies—France and Germany—have largely kept their investments in Chinese assets after a four- to sixfold expansion that started in the mid-2000s. In contrast, the financially weakest countries have accounted for the largest increases in trade volumes between China and the Eurozone. We also find that trade volumes are correlated with holdings of Chinese financial assets but assets rose at a substantially smaller rate than trade. These results show that China and the Eurozone continue to be asymmetrically integrated, whereby Eurozone countries still invest more timidly in Chinese financial assets compared to the aggressive trade and infrastructure partnerships initiated by China. We discuss the implications for future financial and trade integration between the two currency areas, which is bound to deepen in light of the Comprehensive Agreement on Investment.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: