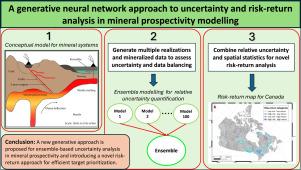

A generative neural network approach to uncertainty and risk-return analysis in mineral prospectivity modelling

IF 3.6

2区 地球科学

Q1 GEOLOGY

引用次数: 0

Abstract

The industrial adoption of machine learning techniques for mineral prospectivity modelling (MPM) remains limited due to their inability to model uncertainties and a lack of systematic frameworks for evaluating risk and return in mineral predictions. A major challenge is that most existing methods fail to simultaneously capture both epistemic uncertainty, which arises from limitations in the predictive modelling process, and aleatoric uncertainty, which stems from the inherent randomness in geoscience data. To address this, we propose a conditional variational autoencoder (CVAE) approach incorporating decoder calibration and uncertainty estimation, which we apply to Canadian magmatic Ni (±Cu ±Co ±PGE) sulphide mineral systems. Aleatoric uncertainty is quantified from the CVAE’s posterior distribution, whereas epistemic uncertainty is assessed from 100 MPM realizations based on datasets generated by the CVAE. We also introduce a novel risk-return framework which integrates relative uncertainty measures with the non-parametric Getis–Ord statistics spatial clustering technique to categorize exploration targets into four distinct risk-return categories. Results from the spatial distribution and kernel density estimation analysis reveal that most known deposits are situated in low-uncertainty zones. Notably, high-return zones, which comprise approximately 4% of the total area, account for 94.7% of the known deposits. This research highlights the significance of incorporating uncertainty and risk-return analysis to improve decision-making in mineral prospecting.

矿产远景建模中不确定性和风险收益分析的生成神经网络方法

由于机器学习技术无法对不确定性进行建模,并且缺乏评估矿物预测风险和回报的系统框架,因此工业采用机器学习技术进行矿物远景建模(MPM)仍然有限。一个主要的挑战是,大多数现有的方法都不能同时捕获由于预测建模过程的限制而产生的认知不确定性和由于地球科学数据固有的随机性而产生的任意不确定性。为了解决这个问题,我们提出了一种结合解码器校准和不确定性估计的条件变分自编码器(CVAE)方法,并将其应用于加拿大岩浆Ni(±Cu±Co±PGE)硫化物矿物系统。任意不确定性是通过CVAE的后验分布来量化的,而认知不确定性是通过基于CVAE生成的数据集的100个MPM实现来评估的。我们还引入了一种新的风险回报框架,该框架将相对不确定性度量与非参数Getis-Ord G *统计空间聚类技术相结合,将勘探目标分为四个不同的风险回报类别。空间分布和核密度估计分析结果表明,大多数已知矿床位于低不确定性带。值得注意的是,高收益带约占总面积的4%,占已知矿床的94.7%。本文的研究突出了将不确定性和风险收益分析相结合对提高找矿决策的意义。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Ore Geology Reviews

地学-地质学

CiteScore

6.50

自引率

27.30%

发文量

546

审稿时长

22.9 weeks

期刊介绍:

Ore Geology Reviews aims to familiarize all earth scientists with recent advances in a number of interconnected disciplines related to the study of, and search for, ore deposits. The reviews range from brief to longer contributions, but the journal preferentially publishes manuscripts that fill the niche between the commonly shorter journal articles and the comprehensive book coverages, and thus has a special appeal to many authors and readers.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: