Financial Geographic Accessibility and Corporate Innovation: An Analysis of Spatial Synergy Based on Land Use and Environmental Sustainability

IF 3.6

2区 农林科学

Q2 ENVIRONMENTAL SCIENCES

引用次数: 0

Abstract

In the face of land degradation and environmental constraints, it is imperative to have an adaptive financial geography structure and a land resource utilization system that supports corporate innovation. This study constructs a refined financial geographic accessibility measurement index. By integrating multi‐source spatio‐temporal big data, the study breaks through the static limitation of traditional statistical data. It accurately analyzes the spatial synergistic effect between the spatial distribution of financial institutions and land use planning. Land use data, such as spatial development rate and spatial interest points, provide high‐precision spatial evidence for revealing the mechanism of financial geographic accessibility affecting corporate innovation. Further, from the environmental sustainability perspective, this paper studies the moderating effect of environmental constraints on corporate innovation. Financial geographic accessibility can improve corporate innovation by reducing financing costs, accelerating knowledge spillover, realizing intermediate input sharing, improving labor matching, and giving play to location advantages. Notably, this facilitation effect performs better in cities with high energy consumption and carbon emissions. Heterogeneity analysis shows that proximity to the city center, low industrial maturity, government subsidies, soes, and large‐scale corporations significantly amplify the innovation benefits of financial geographic accessibility. This study combines remote sensing data with spatial big data to provide a new methodological framework for analyzing land use and degradation.金融地理可达性与企业创新:基于土地利用与环境可持续性的空间协同分析

面对土地退化和环境约束,具有适应性的金融地理结构和支持企业创新的土地资源利用制度势在必行。本文构建了一个精细化的金融地理可达性测度指标。通过整合多源时空大数据,突破了传统统计数据的静态局限。准确分析了金融机构空间布局与土地利用规划之间的空间协同效应。土地利用数据(如空间发展率和空间兴趣点)为揭示金融地理可达性影响企业创新的机制提供了高精度的空间证据。进一步,本文从环境可持续性的角度,研究了环境约束对企业创新的调节作用。金融地理可达性可以通过降低融资成本、加速知识溢出、实现中间投入共享、改善劳动力匹配、发挥区位优势等方式促进企业创新。值得注意的是,这种促进效应在高能耗和高碳排放的城市表现得更好。异质性分析表明,靠近城市中心、产业成熟度低、政府补贴、国有企业和大型企业显著放大了金融地理可达性的创新效益。本研究将遥感数据与空间大数据相结合,为分析土地利用与退化提供了新的方法框架。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Land Degradation & Development

农林科学-环境科学

CiteScore

7.70

自引率

8.50%

发文量

379

审稿时长

5.5 months

期刊介绍:

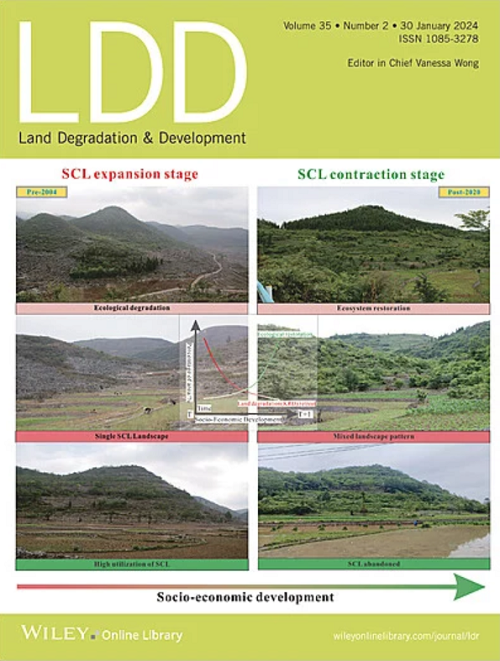

Land Degradation & Development is an international journal which seeks to promote rational study of the recognition, monitoring, control and rehabilitation of degradation in terrestrial environments. The journal focuses on:

- what land degradation is;

- what causes land degradation;

- the impacts of land degradation

- the scale of land degradation;

- the history, current status or future trends of land degradation;

- avoidance, mitigation and control of land degradation;

- remedial actions to rehabilitate or restore degraded land;

- sustainable land management.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: