Does prior success influence risk-taking in foreign location decisions? A prospect theory perspective

Abstract

Research Summary

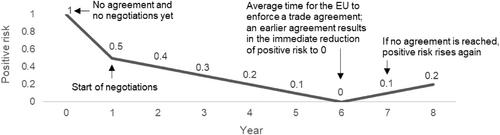

Research suggests that foreign direct investment decisions can be biased and deviate from economic theory. This study deploys prospect theory to analyze the impact of the success of previous investments on risk-taking in subsequent investment decisions. Our theorizing suggests that prior success influences foreign investors' decisions to take host-country risk, and that this moderating influence on the risk-investment relation is specific to the type of risk. The results of an event-history study of 1259 location decisions support the notion that the success of previous investments encourages investors to enter host countries with high negative or positive risk, whereas it discourages them from entering locations with high mixed risk. The effects are stronger for investment locations that are similar than for those that are dissimilar.

Managerial Summary

Regarding the varying risks that investors face in foreign countries, investment decisions may sometimes appear rather confident and sometimes rather cautious. Our study relates these decisions to the success that investors had with similar investments in the past, since research suggests that experiencing gains or losses can influence decision behavior. The results suggest that prior success affects risk-taking in foreign direct investment decisions and comes in contrary forms, depending on the type of risk: prior success leads to overconfident investment decisions in the case of negative and positive risk, whereas it induces overcautious investment decisions in the case of mixed risk. Being aware of these behavioral tendencies can prevent managers from making biased investment decisions.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: