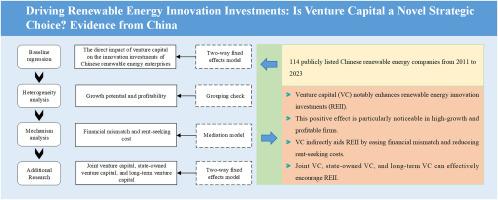

Driving renewable energy innovation investments: Is venture capital a novel strategic choice? Evidence from China

IF 9

1区 工程技术

Q1 ENERGY & FUELS

引用次数: 0

Abstract

The relationship between venture capital (VC) and corporate innovation has been a topic of debate. Most existing studies have focused on the general effects of VC on innovation investments, neglecting the specific mechanisms. In the global transition toward low-carbon energy, renewable energy (RE) is increasingly becoming a focus area for VC. However, whether VC can effectively stimulate innovation investments in RE firms remains uncertain. This study addressed these gaps by systematically investigating the impact of VC on renewable energy innovation investments (REII) using data from 114 listed RE companies in China from 2011 to 2023. Our findings demonstrate that VC significantly stimulates REII, with a particularly pronounced effect in high-growth and profitable companies, thereby providing new empirical evidence to the ongoing debate on VC's role in corporate innovation. Furthermore, we uncover that VC not only alleviates financial mismatch but also reduces rent-seeking costs, thereby indirectly fostering innovation. These mechanisms help explain how VC can enhance the innovation capabilities of RE companies. Lastly, we find that joint VC, state-owned VC, and long-term VC are especially conducive to promoting innovation. Based on these findings, we offered targeted policy suggestions to boost the innovation potential of China's RE sector.

推动可再生能源创新投资:风险投资是一种新的战略选择吗?来自中国的证据

风险投资(VC)与企业创新之间的关系一直是一个争论不休的话题。现有研究大多关注风险投资对创新投资的一般影响,而忽视了具体机制。在全球向低碳能源转型的过程中,可再生能源(RE)日益成为风险投资的重点领域。然而,风险投资能否有效刺激可再生能源企业的创新投资仍不确定。本研究利用 2011 年至 2023 年中国 114 家可再生能源上市公司的数据,系统研究了风险投资对可再生能源创新投资(REII)的影响,从而弥补了上述不足。我们的研究结果表明,风险投资极大地刺激了可再生能源创新投资,对高增长和高盈利公司的影响尤为明显,从而为目前关于风险投资在企业创新中的作用的讨论提供了新的经验证据。此外,我们还发现,风险投资不仅能缓解财务错配,还能降低寻租成本,从而间接促进创新。这些机制有助于解释风险投资如何增强可再生能源公司的创新能力。最后,我们发现联合风险投资、国有风险投资和长期风险投资尤其有利于促进创新。基于这些发现,我们提出了有针对性的政策建议,以提升中国可再生能源行业的创新潜力。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Renewable Energy

工程技术-能源与燃料

CiteScore

18.40

自引率

9.20%

发文量

1955

审稿时长

6.6 months

期刊介绍:

Renewable Energy journal is dedicated to advancing knowledge and disseminating insights on various topics and technologies within renewable energy systems and components. Our mission is to support researchers, engineers, economists, manufacturers, NGOs, associations, and societies in staying updated on new developments in their respective fields and applying alternative energy solutions to current practices.

As an international, multidisciplinary journal in renewable energy engineering and research, we strive to be a premier peer-reviewed platform and a trusted source of original research and reviews in the field of renewable energy. Join us in our endeavor to drive innovation and progress in sustainable energy solutions.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: