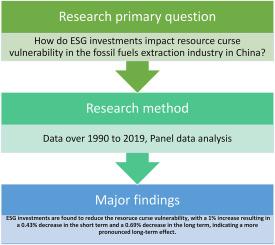

Is ESG improvement an efficient green solution for resource curse vulnerability of enterprise management? Evidence from fossil fuels extraction industry

IF 10.2

2区 经济学

0 ENVIRONMENTAL STUDIES

引用次数: 0

Abstract

The resource curse phenomenon poses serious challenges for many economies globally. This study examines the impact of Environmental, Social, and Governance (ESG) investments on the Resource Curse Vulnerability Index for 40 Chinese fossil fuel enterprises listed on the Shanghai Stock Exchange from 2016 to 2020. Using an autoregressive distributed lag approach, results show that ESG investments reduce vulnerability, with a 1% increase leading to a 0.43% decrease in the short term and 0.69% in the long term. However, higher total liabilities and increased Research and Development (R&D) expenditures exacerbate vulnerability. These findings suggest that financial strain and management complexity heighten resource curse risks. Policies promoting robust ESG standards, transparent reporting, and stricter anti-greenwashing regulations are crucial for sustainable enterprise management.

ESG改进是解决企业管理中资源诅咒脆弱性的有效绿色解决方案吗?化石燃料开采业的证据

资源诅咒现象给全球许多经济体带来了严峻挑战。本研究考察了环境、社会和治理(ESG)投资对 40 家在上海证券交易所上市的中国化石燃料企业 2016 年至 2020 年资源诅咒脆弱性指数的影响。使用自回归分布滞后法,结果显示 ESG 投资降低了脆弱性,每增加 1%,短期内会降低 0.43%,长期内会降低 0.69%。然而,负债总额的增加和研发(R&D)支出的增加会加剧脆弱性。这些研究结果表明,财务压力和管理复杂性加剧了资源诅咒风险。促进健全的环境、社会和公司治理标准、透明的报告和更严格的反 "洗绿 "法规的政策对于可持续的企业管理至关重要。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Resources Policy

ENVIRONMENTAL STUDIES-

CiteScore

13.40

自引率

23.50%

发文量

602

审稿时长

69 days

期刊介绍:

Resources Policy is an international journal focused on the economics and policy aspects of mineral and fossil fuel extraction, production, and utilization. It targets individuals in academia, government, and industry. The journal seeks original research submissions analyzing public policy, economics, social science, geography, and finance in the fields of mining, non-fuel minerals, energy minerals, fossil fuels, and metals. Mineral economics topics covered include mineral market analysis, price analysis, project evaluation, mining and sustainable development, mineral resource rents, resource curse, mineral wealth and corruption, mineral taxation and regulation, strategic minerals and their supply, and the impact of mineral development on local communities and indigenous populations. The journal specifically excludes papers with agriculture, forestry, or fisheries as their primary focus.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: