Institutional openness and analyst competition in China's capital market: Evidence of information acquisition advantages

IF 4.2

2区 经济学

Q1 ECONOMICS

引用次数: 0

Abstract

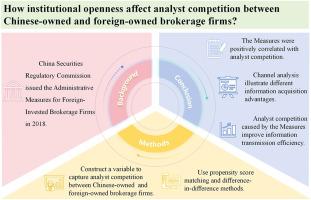

The factors driving analyst competition have emerged as a critical research topic while firm characteristics and external environments affect analyst competition. However, the impact of institutional openness is underexplored in the current literature. Based on a quasi–natural experiment of the Administrative Measures for Foreign-Invested Brokerage Firms, we examined the effects of institutional openness on analyst competition using a difference–in–differences model (DID). Our research illustrates that greater institutional openness improves analyst competition through information acquisition advantages. The positive impact of institutional openness on analyst competition was more pronounced in brokerage firms with shorter establishment times and companies with less investor attention. Finally, analyst competition caused by institutional openness enhanced the market information transmission efficiency. The findings provide essential contributions to understanding the institutional openness effect and characteristics of the analyst industry.

中国资本市场的制度开放与分析师竞争:信息获取优势的证据

在公司特征和外部环境影响分析师竞争的同时,分析师竞争的驱动因素已成为一个重要的研究课题。然而,在目前的文献中,对制度开放度的影响还缺乏深入研究。基于《外商投资证券公司管理办法》的准自然实验,我们使用差分模型(DID)研究了制度开放对分析师竞争的影响。我们的研究表明,提高机构开放度可以通过信息获取优势改善分析师竞争。机构开放对分析师竞争的积极影响在成立时间较短的券商和投资者关注度较低的公司中更为明显。最后,机构开放带来的分析师竞争提高了市场信息传递效率。研究结果为理解制度开放效应和分析师行业特征做出了重要贡献。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Economic Modelling

ECONOMICS-

CiteScore

8.00

自引率

10.60%

发文量

295

期刊介绍:

Economic Modelling fills a major gap in the economics literature, providing a single source of both theoretical and applied papers on economic modelling. The journal prime objective is to provide an international review of the state-of-the-art in economic modelling. Economic Modelling publishes the complete versions of many large-scale models of industrially advanced economies which have been developed for policy analysis. Examples are the Bank of England Model and the US Federal Reserve Board Model which had hitherto been unpublished. As individual models are revised and updated, the journal publishes subsequent papers dealing with these revisions, so keeping its readers as up to date as possible.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: