Analysis of financial contagion among economic sectors through Dynamic Bayesian Networks

IF 4.4

2区 化学

Q2 MATERIALS SCIENCE, MULTIDISCIPLINARY

引用次数: 0

Abstract

Crises severely impact economies and may spread across regions or sectors in a process called contagion. Understanding this process is crucial for anticipating crises’ effects and implementing mitigative strategies. Specific economic sectors may be major crisis propagators: banking and insurance are often considered decisive in this context. This study employs Dynamic Bayesian Networks to model sectoral interdependencies within the U.S. economy, utilizing daily data from nine Dow Jones industrial indices over the period 2000–2020. As a secondary objective, we evaluate whether the insurance industry plays a central role in spreading crises. Several crisis periods are analyzed, from dot-com bubble to Covid-19 pandemic. The results reveal the subprime crisis, European debt crisis and the 2016 presidential election as the main contagious periods. The last analyzed period – Covid-19 pandemic – was divided in two phases, showing, on phase 1, an interconnected economic system with three main spreaders (Oil & Gas, Real Estate and Pharmaceutical) and, on phase 2, the same configuration of the post-subprime. Furthermore, although the insurance sector was somehow relevant during subprime crisis, it primarily acts as a contagion receptor, specially from the banking sector, with the correlation between them being the highest of all, reaching 0.49 at the last period.

通过动态贝叶斯网络分析经济部门间的金融传染

危机严重影响经济,并可能通过一种称为 "传染 "的过程跨地区或跨部门扩散。了解这一过程对于预测危机影响和实施缓解战略至关重要。特定的经济部门可能是危机的主要传播者:在这种情况下,银行业和保险业往往被认为是决定性的。本研究利用动态贝叶斯网络(Dynamic Bayesian Networks)对美国经济中的行业相互依存关系进行建模,利用的是 2000-2020 年间九个道琼斯工业指数的每日数据。作为次要目标,我们评估了保险业是否在危机蔓延中发挥了核心作用。我们分析了从网络泡沫到 Covid-19 大流行的几个危机时期。结果表明,次贷危机、欧洲债务危机和 2016 年总统大选是主要的传染期。最后分析的时期--Covid-19 大流行病--分为两个阶段,在第一阶段显示了一个相互关联的经济体系,有三个主要传播者(石油和amp;天然气、房地产和制药),在第二阶段显示了与次贷后相同的配置。此外,尽管保险业在次贷危机期间也有一定的相关性,但它主要是作为一个传染源,特别是来自银行业的传染源,两者之间的相关性最高,在最后一个阶段达到 0.49。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

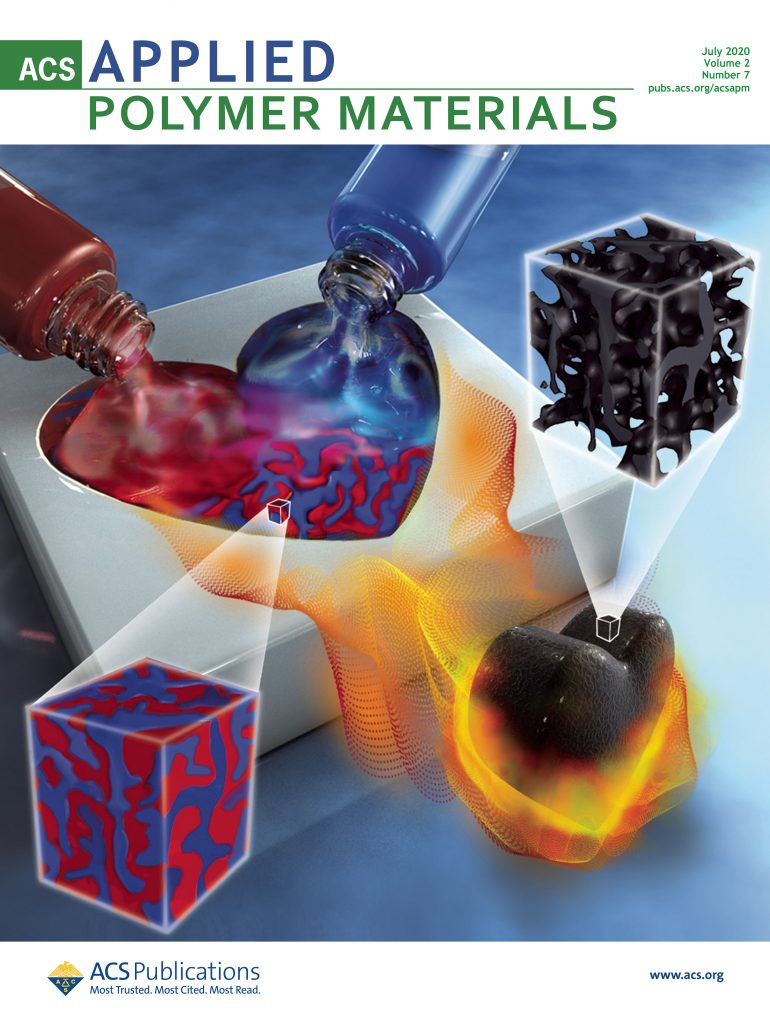

ACS Applied Polymer Materials

Multiple-

CiteScore

7.20

自引率

6.00%

发文量

810

期刊介绍:

ACS Applied Polymer Materials is an interdisciplinary journal publishing original research covering all aspects of engineering, chemistry, physics, and biology relevant to applications of polymers.

The journal is devoted to reports of new and original experimental and theoretical research of an applied nature that integrates fundamental knowledge in the areas of materials, engineering, physics, bioscience, polymer science and chemistry into important polymer applications. The journal is specifically interested in work that addresses relationships among structure, processing, morphology, chemistry, properties, and function as well as work that provide insights into mechanisms critical to the performance of the polymer for applications.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: