Being stranded with fossil fuel reserves? Climate policy risk and the pricing of bank loans

Q1 Economics, Econometrics and Finance

引用次数: 0

Abstract

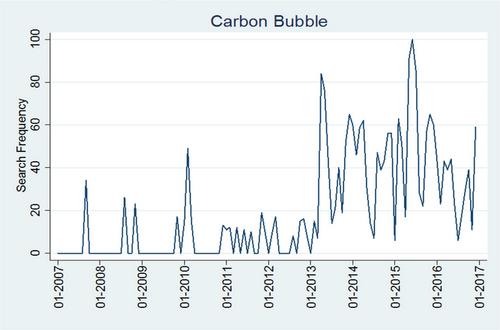

Do banks price the risk of stranded fossil fuel reserves? To address this question, we hand collect global data on corporate fossil fuel reserves from 2002 to 2016, match it with syndicated loans, and subsequently compare the loan rate charged to fossil fuel firms — along their climate policy exposure — to other firms. We find that banks price climate policy exposure, especially after 2015. We also uncover that our main effect further increases for loans with longer maturity, that loan size to fossil fuel firms increases, and that ‛Green’ banks also charge higher loan rates to fossil fuel firms.

化石燃料储备搁浅?气候政策风险与银行贷款定价

银行是否对搁浅的化石燃料储备风险进行定价?为了解决这个问题,我们手工收集了 2002 年至 2016 年全球企业化石燃料储备数据,将其与银团贷款相匹配,然后将化石燃料企业的贷款利率--连同其气候政策风险--与其他企业进行比较。我们发现,银行会对气候政策风险进行定价,尤其是在 2015 年之后。我们还发现,对于期限较长的贷款,我们的主要效应会进一步增加,对化石燃料企业的贷款规模也会增加,"绿色 "银行也会对化石燃料企业收取更高的贷款利率。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Financial Markets, Institutions and Instruments

Economics, Econometrics and Finance-Economics, Econometrics and Finance (all)

CiteScore

1.80

自引率

0.00%

发文量

17

期刊介绍:

Financial Markets, Institutions and Instruments bridges the gap between the academic and professional finance communities. With contributions from leading academics, as well as practitioners from organizations such as the SEC and the Federal Reserve, the journal is equally relevant to both groups. Each issue is devoted to a single topic, which is examined in depth, and a special fifth issue is published annually highlighting the most significant developments in money and banking, derivative securities, corporate finance, and fixed-income securities.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: