ASSET DIVERSIFICATION VERSUS CLIMATE ACTION

IF 1.3

3区 经济学

Q2 ECONOMICS

引用次数: 0

Abstract

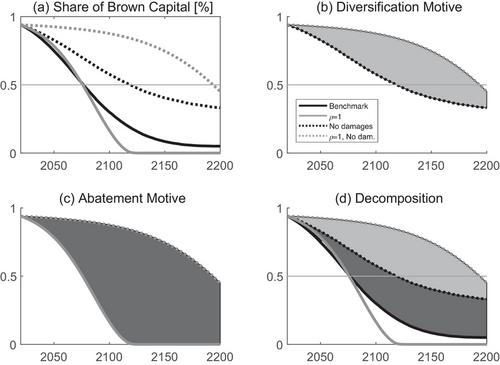

Asset pricing and climate policy are analyzed in a global economy where consumption goods are produced by both a green and a carbon-intensive sector. Given that the economy is initially heavily dependent on carbon-intensive capital, the desire to diversify assets complements the attempt to mitigate economic damages from climate change. In the longer run, however, a trade-off between diversification and climate action emerges. We derive the optimal carbon price and the equilibrium risk-free rate, and risk premia. Climate disasters significantly decrease the risk-free rate but increase risk premia on financial assets, especially if no climate policy is implemented.

资产多样化与气候行动

在全球经济中,消费品既由绿色部门生产,也由碳密集部门生产,在这种情况下,对资产定价和气候政策进行了分析。鉴于经济最初严重依赖碳密集型资本,资产多样化的愿望与减轻气候变化对经济造成的损害的努力相辅相成。然而,从长远来看,多样化和气候行动之间会出现权衡。我们推导出了最优碳价格、均衡无风险利率和风险溢价。气候灾害大大降低了无风险利率,但增加了金融资产的风险溢价,尤其是在不实施气候政策的情况下。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

International Economic Review

ECONOMICS-

CiteScore

2.60

自引率

0.00%

发文量

0

期刊介绍:

The International Economic Review was established in 1960 to provide a forum for modern quantitative economics. From its inception, the journal has tried to stimulate economic research around the world by publishing cutting edge papers in many areas of economics, including econometrics, economic theory, macro, and applied economics.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: