Cross-investments by multinationals: A new perspective

Abstract

Research Summary

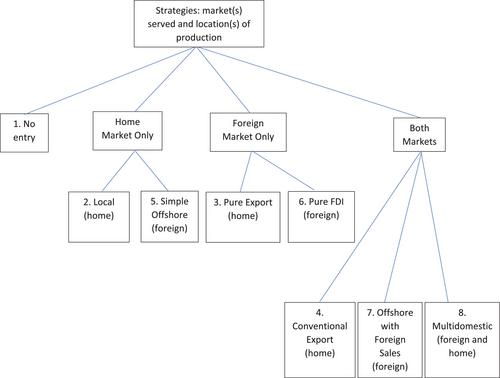

Cross-flows of foreign direct investment (FDI) occur when firms invest in each other's home countries, affecting the terms of competition in each market. They are explained by internalization theory but have never been comprehensively investigated. This article models cross-investment in a duopoly with differentiated products. The firms decide whether to enter each market and whether to serve it through trade or local production. The model combines firm-, country-, and industry-level factors. It places cross-investment in the wider context of cross-sourcing, including cross-trading and asymmetric sourcing. It reveals different forms of cross-investment rather than being limited to cross-multidomestic. Overall, cross-investment is favored by highly differentiated products, low comparative advantage, large markets, high trade costs, and low costs of FDI.

Managerial Summary

Cross-investment, where firms conduct FDI into each other's home countries, is an important phenomenon but has received little recent attention in international business literature. This article seeks, through mathematical modeling, to establish a better understanding of it in the wider context of cross-sourcing. This helps to show how the strategy of the individual firm fits with those of the other firms in an international industry and how different possible industry structures and performance levels result. It includes choices over the locations from which markets are served being a potential source of first-mover advantage. For instance, committing to producing in a country could reduce the cost of serving its market, potentially altering the equilibrium outcome in favor of the first mover.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: