The Role of Systemic Risk Spillovers in the Transmission of Euro Area Monetary Policy

IF 1.5

4区 经济学

Q2 ECONOMICS

引用次数: 1

Abstract

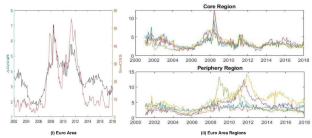

This paper empirically investigates the transmission of systemic risk across the Euro Area by employing a Global VAR model. We find that a union aggregate systemic risk shock results in a sharp decline in output, with two thirds of the response to be attributed to cross-country spillovers. The results indicate that peripheral economies have a disproportionate importance in spreading systemic risk compared to core countries. Then, we incorporate high-frequency monetary surprises into the model and we find evidence of the risk-taking channel of monetary policy. However, the relationship is reversed in the period of the ZLB, when expansionary shocks mitigate systemic risk, since they reduce market uncertainty and funding risk. Cross-country spillovers account for a significant fraction (17.4%) of systemic risk responses’ variation. We also show that near term guidance reduces systemic risk, whereas the initiation of the QE program has the opposite effect. Finally, the effectiveness of monetary policy exhibits significant asymmetries, with core countries driving the union response.

系统性风险溢出在欧元区货币政策传导中的作用

本文采用全球VAR模型对欧元区的系统性风险传导进行实证研究。我们发现,综合系统性风险冲击会导致产出急剧下降,其中三分之二的反应可归因于跨国溢出效应。结果表明,与核心国家相比,外围经济体在分散系统性风险方面具有不成比例的重要性。然后,我们将高频货币意外纳入模型,并找到了货币政策风险承担渠道的证据。然而,在ZLB时期,这种关系是相反的,当扩张性冲击减轻系统性风险时,因为它们降低了市场不确定性和融资风险。跨国溢出效应占系统性风险应对变化的很大一部分(17.4%)。我们还表明,短期指导可以降低系统性风险,而启动量化宽松计划则会产生相反的效果。最后,货币政策的有效性表现出明显的不对称性,核心国家推动了欧盟的反应。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Open Economies Review

ECONOMICS-

CiteScore

2.30

自引率

16.70%

发文量

40

期刊介绍:

The topics covered in Open Economies Review include, but are not limited to, models and applications of (1) trade flows, (2) commercial policy, (3) adjustment mechanism to external imbalances, (4) exchange rate movements, (5) alternative monetary regimes, (6) real and financial integration, (7) monetary union, (8) economic development and (9) external debt. Open Economies Review welcomes original manuscripts, both theoretical and empirical, dealing with international economic issues or national economic issues that have transnational relevance. Furthermore, Open Economies Review solicits contributions bearing on specific events on important branches of the literature. Open Economies Review is open to any and all contributions, without preferences for any particular viewpoint or school of thought. Open Economies Review encourages interdisciplinary communication and interaction among researchers in the vast area of international and transnational economics. Authors will be expected to meet the scientific standards prevailing in their respective fields, and empirical findings must be reproducible. Regardless of degree of complexity and specificity, authors are expected to write an introduction, setting forth the nature of their research and the significance of their findings, in a manner accessible to researchers in other disciplines. Officially cited as: Open Econ Rev

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: