Does the Interest Parity Puzzle Hold for Central and Eastern European Economies?

IF 1

4区 经济学

Q2 ECONOMICS

引用次数: 0

Abstract

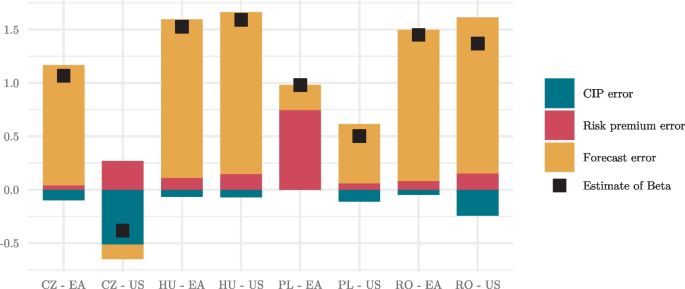

Abstract This paper examines the uncovered interest parity puzzle in Central and Eastern European countries. Apart from investigating baseline UIP regressions, we check for structural breaks in this relationship, scrutinize deviations from the UIP, and employ different estimation methods and models augmented with various risk measures. Moreover, we offer several extensions to the common UIP testing that account for foreign-exchange interventions, the implied volatility of exchange rates, and the limited availability of data on direct measures of market expectations. The study shows that the choice of the reference currency matters for the outcome of the interest parity tests in the CEE economies. In particular, we demonstrate that inconsistencies between the results of the UIP tests vis-à-vis the euro and the US dollar that appear in CEE economies may be accounted for by the movements of the euro-dollar risk premium. This regularity has not been documented in previous studies. Additionally, we show that (a) the FX interventions in Czechia distorted the UIP, (b) the directly measured exchange rate expectations (granular survey data) in Poland do not seem to be informed by the UIP relationship, (c) the limited resilience of CEE economies to rare disasters may plausibly explain deviations from the UIP.

利率平价之谜是否适用于中东欧经济体?

摘要本文考察了中欧和东欧国家未揭示的利率平价之谜。除了研究基线UIP回归外,我们还检查了这种关系中的结构性断裂,仔细检查了与UIP的偏差,并采用了不同的估计方法和模型,增加了各种风险度量。此外,我们对常见的UIP测试提供了几个扩展,这些测试考虑了外汇干预、汇率隐含波动率以及市场预期直接度量数据的有限可用性。研究表明,参考货币的选择关系到中东欧经济体利率平价测试的结果。特别是,我们证明,在中东欧经济体中出现的UIP测试结果与-à-vis欧元和美元之间的不一致可能是由欧元-美元风险溢价的变动造成的。这种规律在以前的研究中没有记录。此外,我们表明(a)捷克的外汇干预扭曲了UIP, (b)波兰直接测量的汇率预期(颗粒调查数据)似乎不受UIP关系的影响,(c)中东欧经济体对罕见灾害的有限弹性可能合理地解释了与UIP的偏差。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Open Economies Review

ECONOMICS-

CiteScore

2.30

自引率

16.70%

发文量

40

期刊介绍:

The topics covered in Open Economies Review include, but are not limited to, models and applications of (1) trade flows, (2) commercial policy, (3) adjustment mechanism to external imbalances, (4) exchange rate movements, (5) alternative monetary regimes, (6) real and financial integration, (7) monetary union, (8) economic development and (9) external debt. Open Economies Review welcomes original manuscripts, both theoretical and empirical, dealing with international economic issues or national economic issues that have transnational relevance. Furthermore, Open Economies Review solicits contributions bearing on specific events on important branches of the literature. Open Economies Review is open to any and all contributions, without preferences for any particular viewpoint or school of thought. Open Economies Review encourages interdisciplinary communication and interaction among researchers in the vast area of international and transnational economics. Authors will be expected to meet the scientific standards prevailing in their respective fields, and empirical findings must be reproducible. Regardless of degree of complexity and specificity, authors are expected to write an introduction, setting forth the nature of their research and the significance of their findings, in a manner accessible to researchers in other disciplines. Officially cited as: Open Econ Rev

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: