Do consumers pay the corporate tax?

IF 3.2

3区 管理学

Q1 BUSINESS, FINANCE

引用次数: 0

Abstract

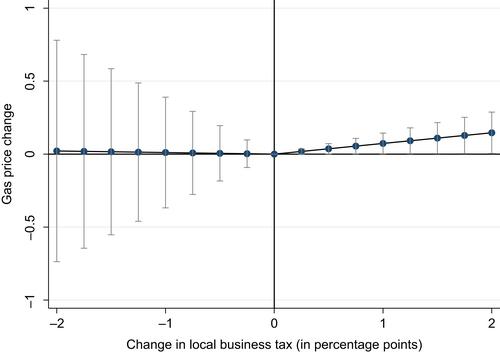

Using granular gas price data and rich variation in corporate tax rates, we find that corporate taxes increase consumer prices. About 64% of the corporate tax is borne by consumers. The effect is stronger when firms have limited access to tax planning opportunities, face stricter tax enforcement, or when consumer demand is less elastic. Taxes also reduce the number of firms and their scale, consistent with a tax-induced increase in marginal cost. Our results suggest that tax policies that increase effective corporate tax rates may have unintended consequences for consumers through higher prices.

消费者缴纳公司税吗?

利用颗粒状天然气价格数据和企业税率的丰富变化,我们发现公司税提高了消费者价格。大约64%的公司税由消费者承担。当企业获得税收规划的机会有限,面临更严格的税收执法,或者消费者需求缺乏弹性时,这种影响会更强。税收也会减少企业的数量和规模,这与税收导致的边际成本增加是一致的。我们的研究结果表明,提高企业有效税率的税收政策可能会通过提高价格对消费者产生意想不到的后果。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Contemporary Accounting Research

BUSINESS, FINANCE-

CiteScore

6.20

自引率

11.10%

发文量

97

期刊介绍:

Contemporary Accounting Research (CAR) is the premiere research journal of the Canadian Academic Accounting Association, which publishes leading- edge research that contributes to our understanding of all aspects of accounting"s role within organizations, markets or society. Canadian based, increasingly global in scope, CAR seeks to reflect the geographical and intellectual diversity in accounting research. To accomplish this, CAR will continue to publish in its traditional areas of excellence, while seeking to more fully represent other research streams in its pages, so as to continue and expand its tradition of excellence.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: