CAPITAL TAX REFORMS WITH POLICY UNCERTAINTY

IF 1.5

3区 经济学

Q2 ECONOMICS

引用次数: 0

Abstract

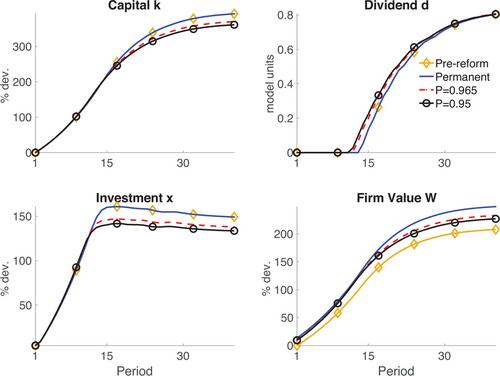

One important feature of capital tax reforms is the uncertainty regarding their duration. In a standard heterogeneous firm framework with financial frictions, we model policy uncertainty by assuming that reforms may be either repealed or maintained with some probability every period. We illustrate the effects of policy uncertainty in the context of the 2003 Bush tax cuts (2003 Job Growth Tax Relief Reconciliation Act), which lowered shareholder taxes. We show that policy uncertainty regarding dividend and capital gains taxes can explain why the Bush tax cuts had no statistically significant effect on investment, in line with the empirical evidence.

具有政策不确定性的资本税改革

资本税改革的一个重要特征是其持续时间的不确定性。在一个具有金融摩擦的标准异质企业框架中,我们假设改革每期都有可能被废除或维持,从而建立了政策不确定性模型。我们以 2003 年布什减税政策(《2003 年就业增长减税协调法案》)为背景,说明了政策不确定性的影响,该法案降低了股东税。我们的研究表明,股息税和资本利得税方面的政策不确定性可以解释为什么布什减税政策在统计上对投资没有显著影响,这与经验证据是一致的。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

International Economic Review

ECONOMICS-

CiteScore

2.60

自引率

0.00%

发文量

0

期刊介绍:

The International Economic Review was established in 1960 to provide a forum for modern quantitative economics. From its inception, the journal has tried to stimulate economic research around the world by publishing cutting edge papers in many areas of economics, including econometrics, economic theory, macro, and applied economics.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: