Heterogeneous responses to corporate marginal tax rates: Evidence from small and large firms

IF 2.3

3区 经济学

Q2 ECONOMICS

引用次数: 0

Abstract

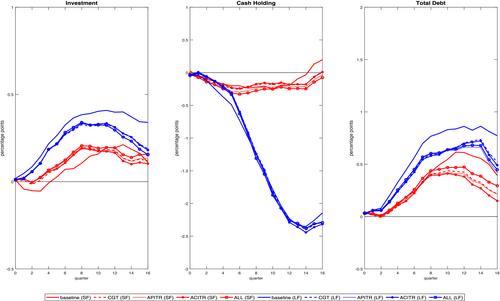

Do small and large firms respond differently to tax cuts? Using new narrative measures of the exogenous variation in corporate marginal tax rates and a unique dataset of US manufacturing firms, we find that the investment of large firms is more sensitive to a marginal tax cut than that of small firms. Furthermore, we show that small firms finance their new investments almost entirely through debt, whereas large firms use both cash and debt. Following a tax cut, the tax advantage of debt financing falls relative to cash financing. This substitution effect is more pronounced for large firms and induces them to rely on cash financing to a larger extent than small firms.

对企业边际税率的异质性反应:来自小型企业和大型企业的证据

小型企业和大型企业对减税的反应是否不同?通过对企业边际税率的外生变化进行新的叙述性测量,并使用独特的美国制造业企业数据集,我们发现大企业的投资对边际减税的敏感度要高于小企业。此外,我们还发现,小企业几乎完全通过债务为新投资融资,而大企业则同时使用现金和债务。减税后,债务融资相对于现金融资的税收优势下降。这种替代效应对大公司更为明显,促使它们比小公司更依赖现金融资。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

来源期刊

Journal of Applied Econometrics

Multiple-

CiteScore

3.70

自引率

4.80%

发文量

63

期刊介绍:

The Journal of Applied Econometrics is an international journal published bi-monthly, plus 1 additional issue (total 7 issues). It aims to publish articles of high quality dealing with the application of existing as well as new econometric techniques to a wide variety of problems in economics and related subjects, covering topics in measurement, estimation, testing, forecasting, and policy analysis. The emphasis is on the careful and rigorous application of econometric techniques and the appropriate interpretation of the results. The economic content of the articles is stressed. A special feature of the Journal is its emphasis on the replicability of results by other researchers. To achieve this aim, authors are expected to make available a complete set of the data used as well as any specialised computer programs employed through a readily accessible medium, preferably in a machine-readable form. The use of microcomputers in applied research and transferability of data is emphasised. The Journal also features occasional sections of short papers re-evaluating previously published papers. The intention of the Journal of Applied Econometrics is to provide an outlet for innovative, quantitative research in economics which cuts across areas of specialisation, involves transferable techniques, and is easily replicable by other researchers. Contributions that introduce statistical methods that are applicable to a variety of economic problems are actively encouraged. The Journal also aims to publish review and survey articles that make recent developments in the field of theoretical and applied econometrics more readily accessible to applied economists in general.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: