The (Ir)Relevance of Rule-of-Thumb Consumers for U.S. Business Cycle Fluctuations

IF 1.2

3区 经济学

Q3 BUSINESS, FINANCE

引用次数: 0

Abstract

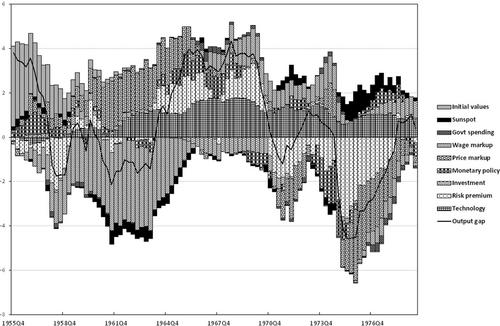

We estimate a medium-scale model with and without rule-of-thumb consumers over the pre-Volcker and the Great Moderation periods, allowing for indeterminacy. Passive monetary policy and sunspot fluctuations characterize the pre-Volcker period for both models. In both subsamples, the estimated fraction of rule-of-thumb consumers is low, such that the two models are empirically almost equivalent; they yield very similar impulse response functions, variance, and historical decompositions. We conclude that rule-of-thumb consumers are irrelevant to explain aggregate U.S. business cycle fluctuations.

拇指规则消费者与美国商业周期波动的(非)相关性

我们估算了沃尔克运动前和大缓和时期有无拇指规则消费者的中型模型,并考虑了不确定性。被动的货币政策和太阳黑子的波动是这两个模型在前沃尔克时期的特征。在这两个子样本中,估计的 "盲从型 "消费者比例都很低,因此这两个模型在经验上几乎是等价的;它们产生的脉冲响应函数、方差和历史分解非常相似。我们的结论是,"盲从型 "消费者与解释美国总体商业周期波动无关。

本文章由计算机程序翻译,如有差异,请以英文原文为准。

求助全文

约1分钟内获得全文

求助全文

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: