生存与价值:企业集团案例

IF 2.1

3区 经济学

Q2 BUSINESS, FINANCE

引用次数: 0

摘要

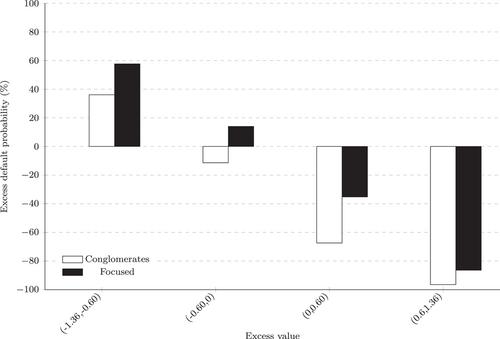

本文研究了当由于缺失对企业在样本中存活的异质性可能性的控制而出现选择偏差时,违约概率与价值之间的关系。我们的模型为企业集团案例提供了以下启示:(a) 企业集团的样本价值随其违约概率的增加而增加,(b) 相对于重点公司,样本企业集团的折价随其超额违约概率的下降而下降,(c) 当分析师对存活概率进行控制时,这两种效应都会消失。这些数据证明,存在着一种选择偏差,它扭曲了存活概率较高的样本公司的相对价值。本文章由计算机程序翻译,如有差异,请以英文原文为准。

Survival and value: The conglomerate case

This paper investigates the relationship between default probability and value when there is a selection bias due to missing controls for firm heterogeneous likelihood to survive in the sample. Our model delivers the following implications for the conglomerate case: (a) the sample conglomerate value increases in their default probability, (b) the sample conglomerate discount falls together with their excess default probability with respect to focused companies, (c) both effects disappear when the analyst controls for survival probability. The data support the presence of a selection bias distorting downwards the relative value of sample firms with higher survival probability.

求助全文

通过发布文献求助,成功后即可免费获取论文全文。

去求助

来源期刊

European Financial Management

BUSINESS, FINANCE-

CiteScore

4.30

自引率

18.20%

发文量

60

期刊介绍:

European Financial Management publishes the best research from around the world, providing a forum for both academics and practitioners concerned with the financial management of modern corporation and financial institutions. The journal publishes signficant new finance research on timely issues and highlights key trends in Europe in a clear and accessible way, with articles covering international research and practice that have direct or indirect bearing on Europe.

求助内容:

求助内容: 应助结果提醒方式:

应助结果提醒方式: